An update has been released, and here is an overview of what was improved in Bankfeed version 24.0.

Contact form

Feel free to leave your question here and we will email you the answer as soon as possible.

An update has been released, and here is an overview of what was improved in Bankfeed version 24.0.

Check out the features of Bankfeed.

Sometimes, our customers encounter situations where the only way to identify the payers is by their names, as no other information from the bank statement can be used.

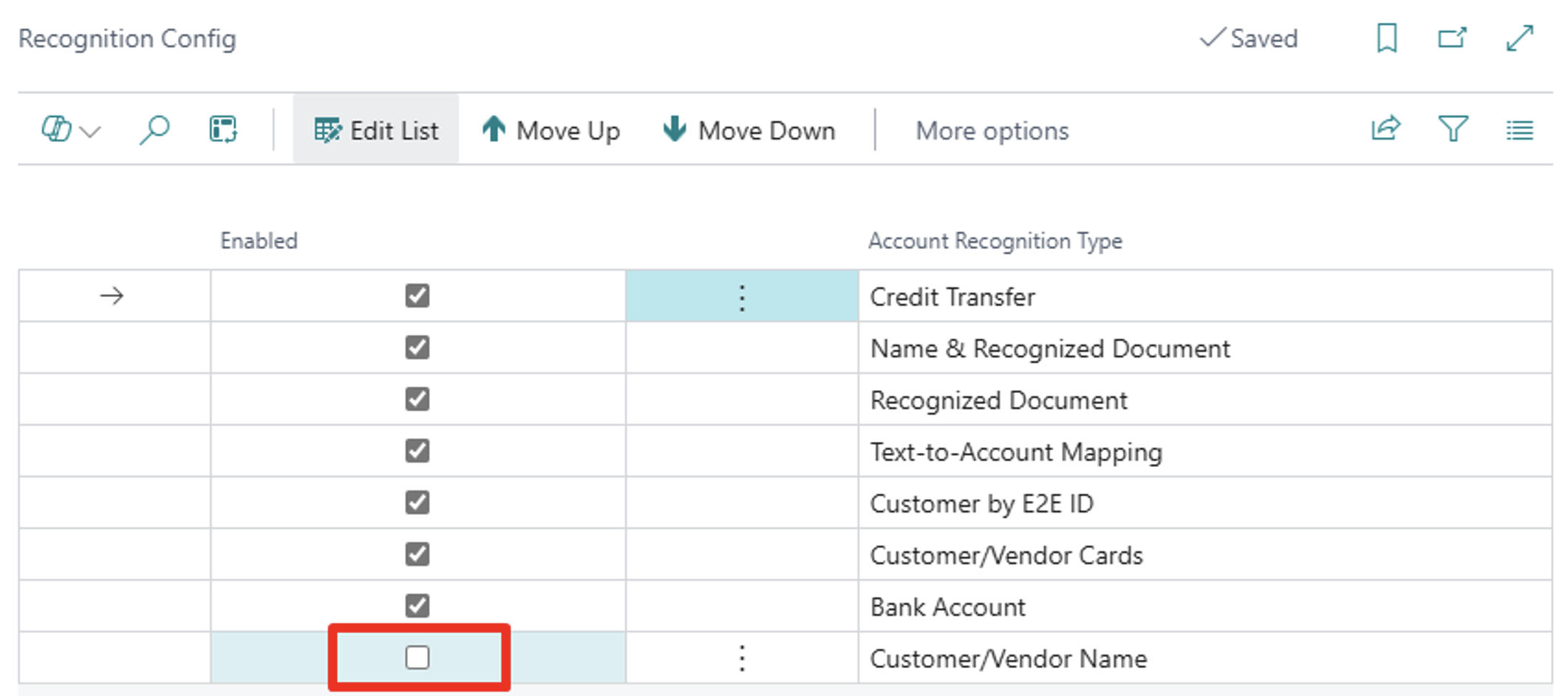

To solve that, we are introducing a new recognition type, which will help with recognizing “Customer/Vendor names.”

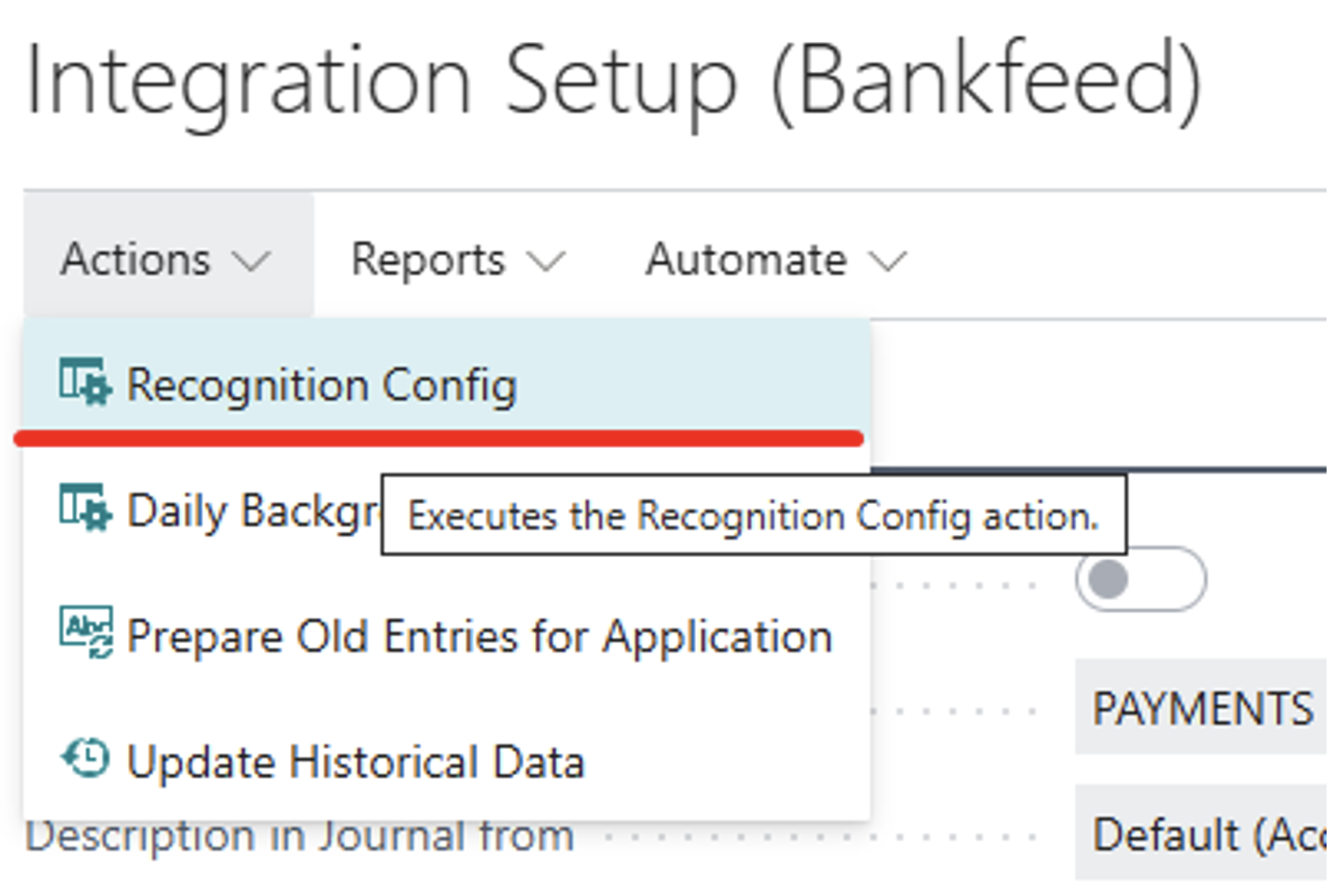

This recogniser will search for names that closely match those of your customers and vendors. To use this feature, you should enable it by following these steps:

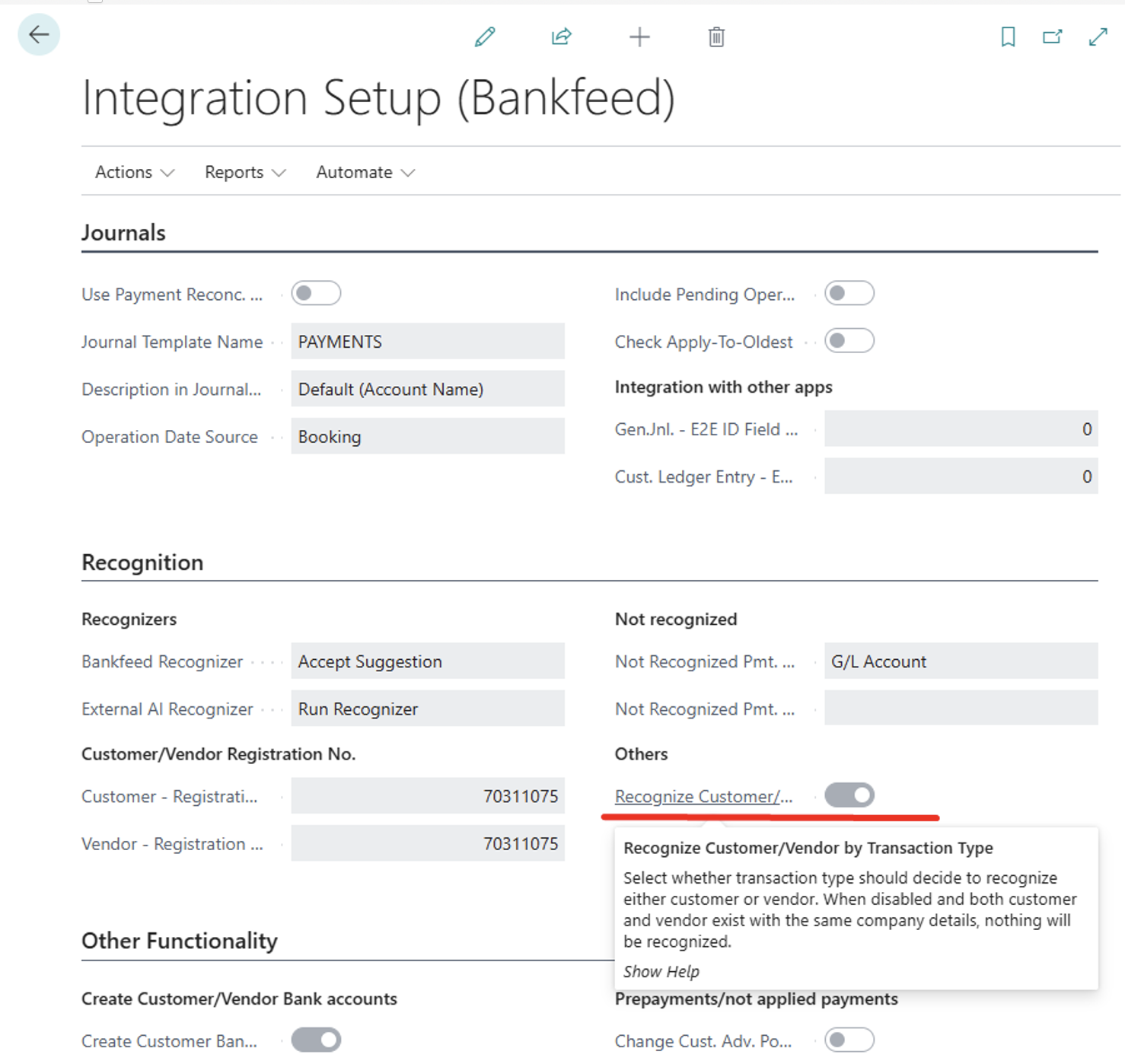

If you have customers and vendors with the same names, please also enable the setup in “Integration Setup (Bankfeed)” to “Recognize Customer/Vendor by Transaction Type.” Otherwise, Bankfeed may skip recognition and fail to assign any Customer/Vendor.

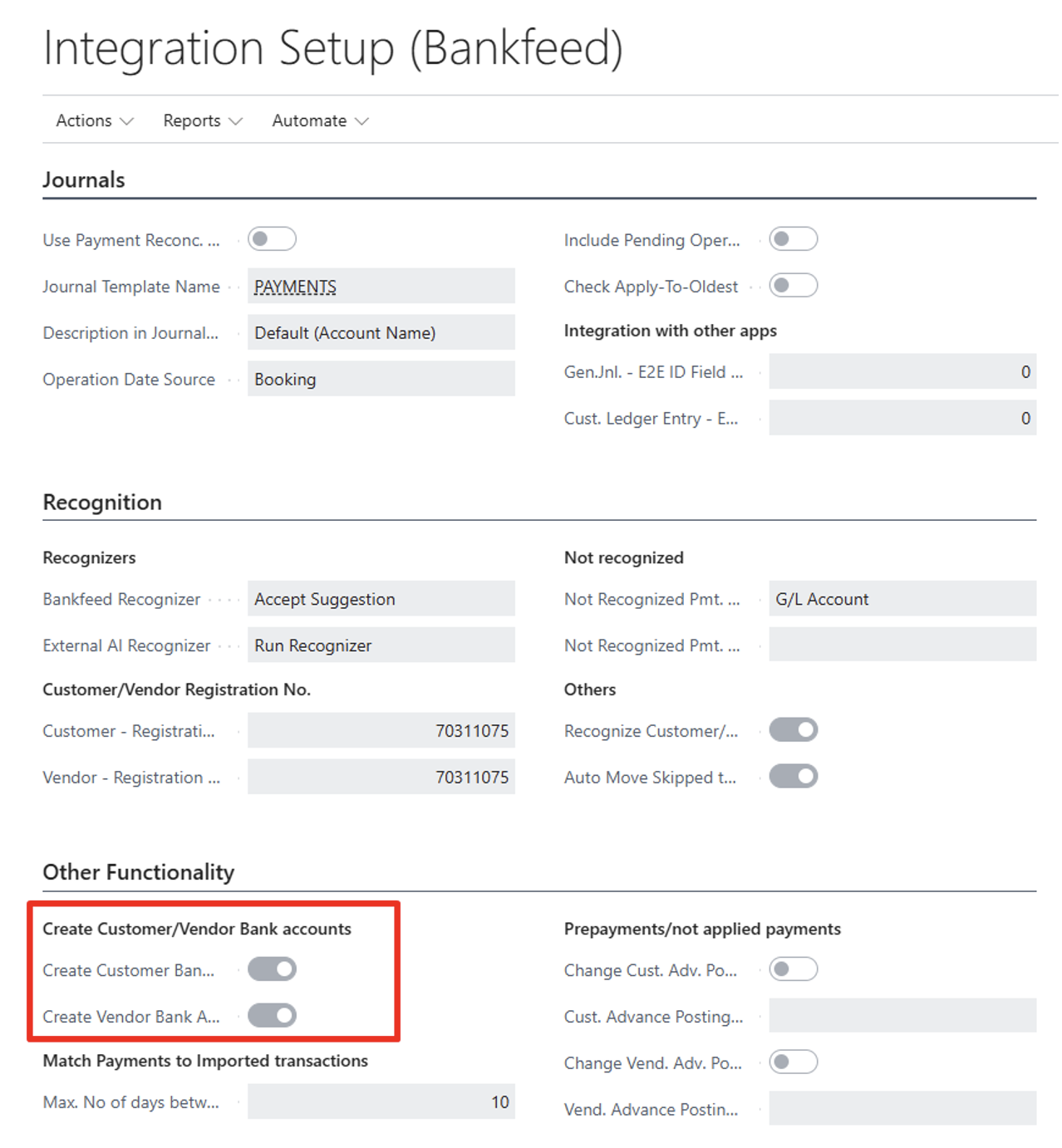

Before this release, the “Create Customer/Vendor Bank account” functionality worked for Customer and Vendor accounts recognized by Bankfeed. However, sometimes mistakes occurred. We improved the functionality to create Customer and Vendor bank accounts for those assigned in the line which may be recognized by Bankfeed or changed/filled by the user. At the time of line posting, Customer and Vendor bank accounts will be created from the bank statement information if it was not filled in before.

To use this functionality, you need to have these checkmarks set in “Integration Setup (Bankfeed)“:

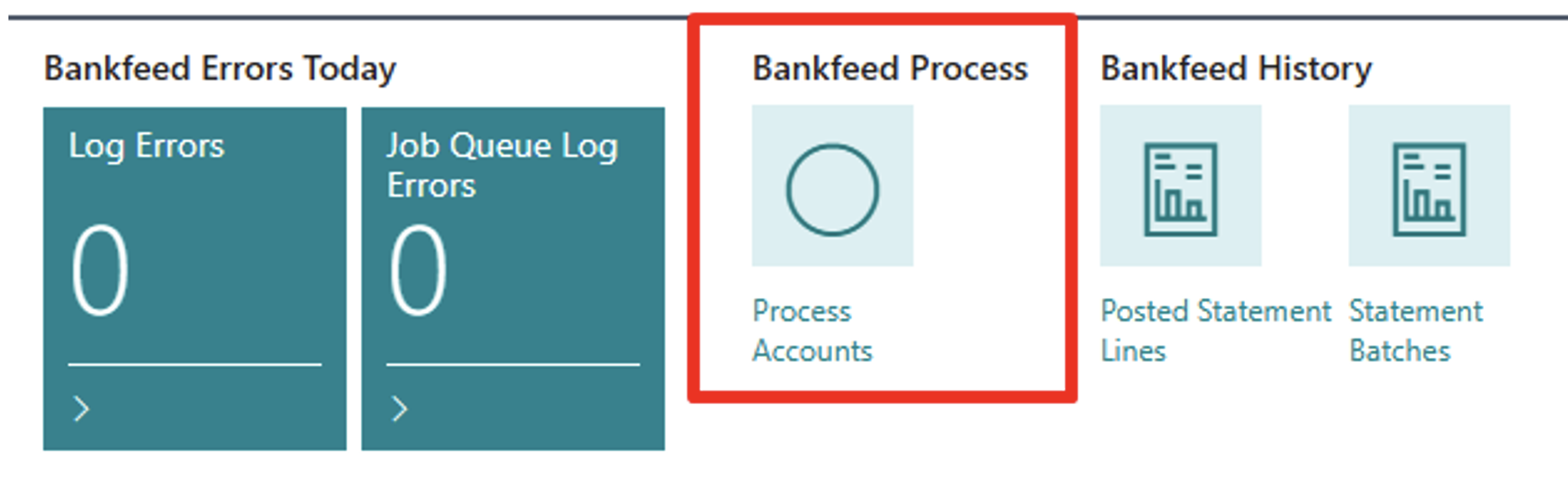

To limit and better control the requests sent to external providers, we have separated the function “Process Accounts (Bankfeed)” into three different functions:

1. “Process Accounts (Bankfeed)” – gets bank statements and transactions

You can still find it in the Role Center as “Process Accounts”:

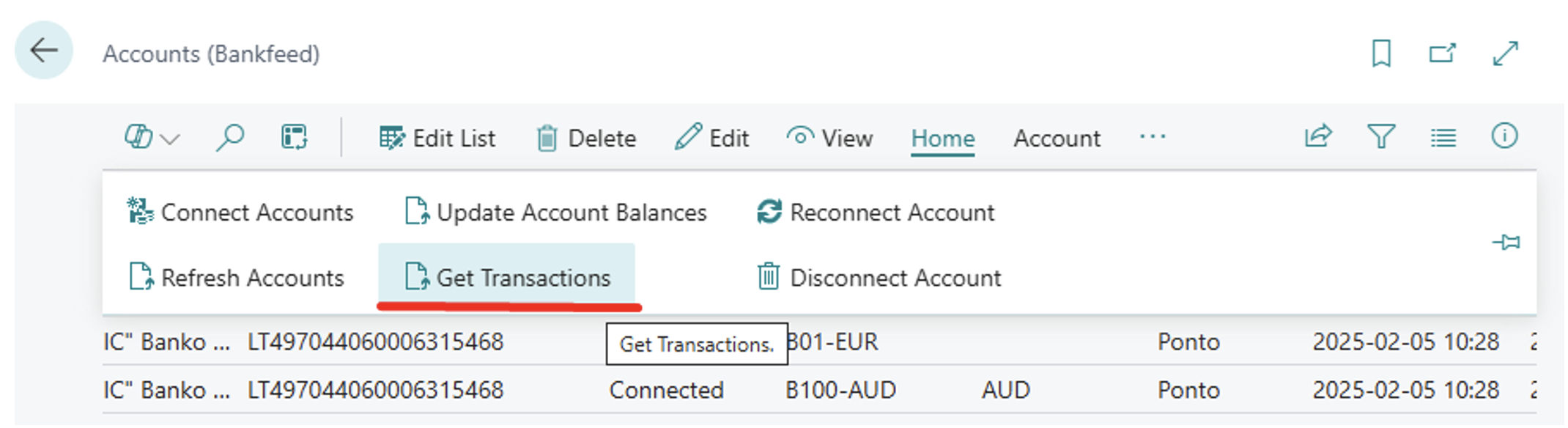

Or on the “Connected Bank Accounts” page “Get Transactions”:

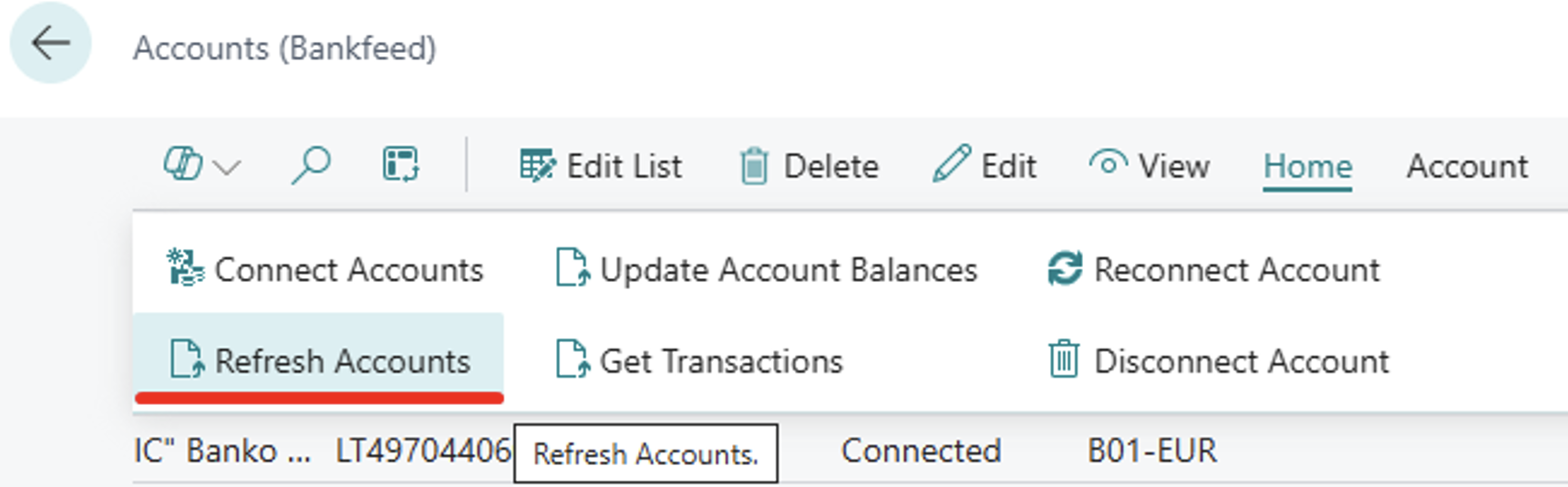

2. “Refresh Accounts” – refreshes the statuses of the connected bank accounts

You will find this function in the “Connected Bank Accounts” page:

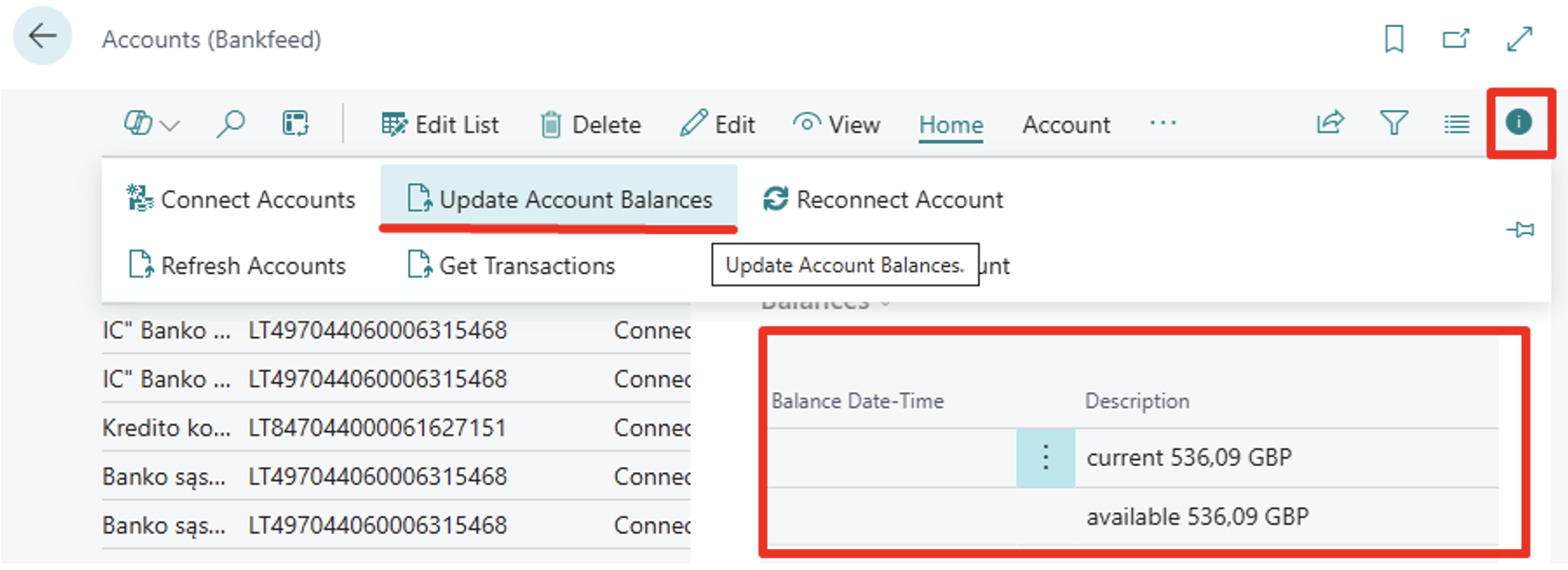

3. “Update Account Balances” – updates the connected bank account balances. Bank balances are shown in the “Connected Bank Accounts” Factbox “Balances”

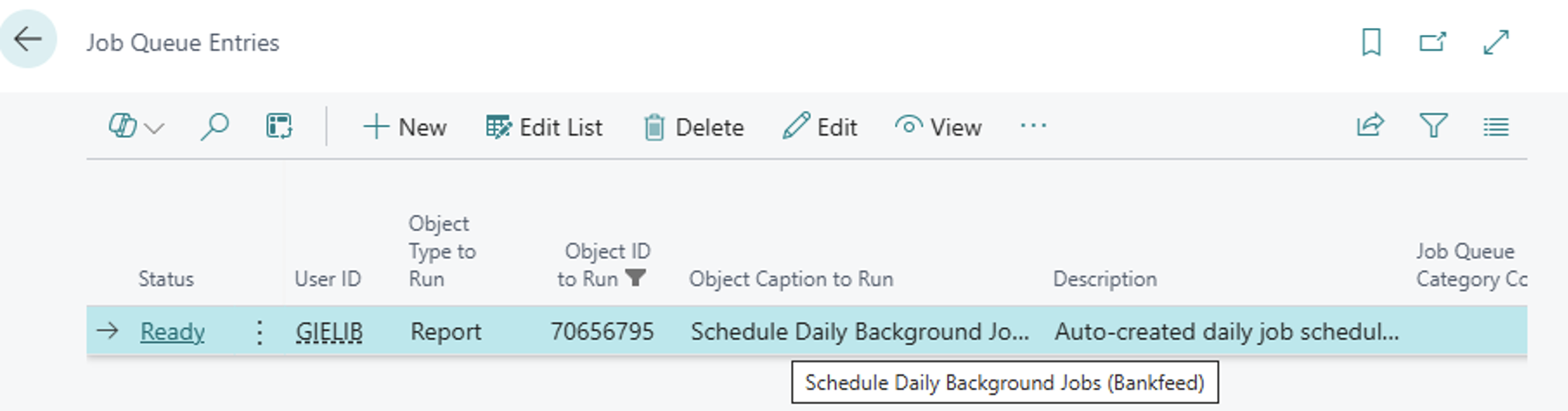

When you upgrade to this new release, all existing Bankfeed Job Queue entries in the database will be deleted. However, there’s no need to worry, as new entries will be automatically created.

Upon installing or upgrading Bankfeed, the Task Scheduler will activate and set the Job Queue entries to run daily.

You may notice that the scheduled times for the Job Queue entries have changed. If this new scheduling causes any issues, you can adjust the times, and those changes will apply to all future Job Queue entries.

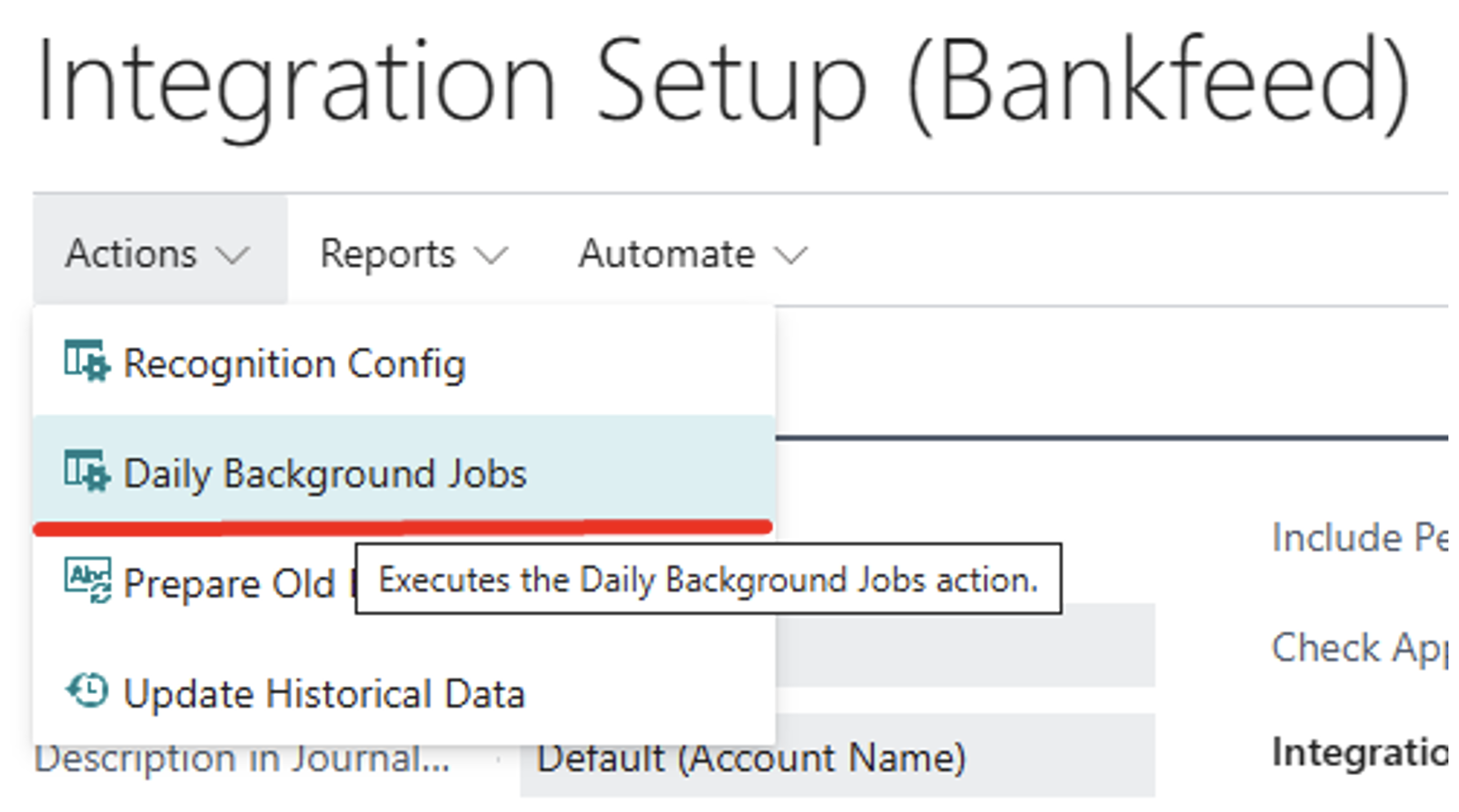

To modify the times, go to “Integration Setup (Bankfeed)” and select “Daily Background Jobs“.

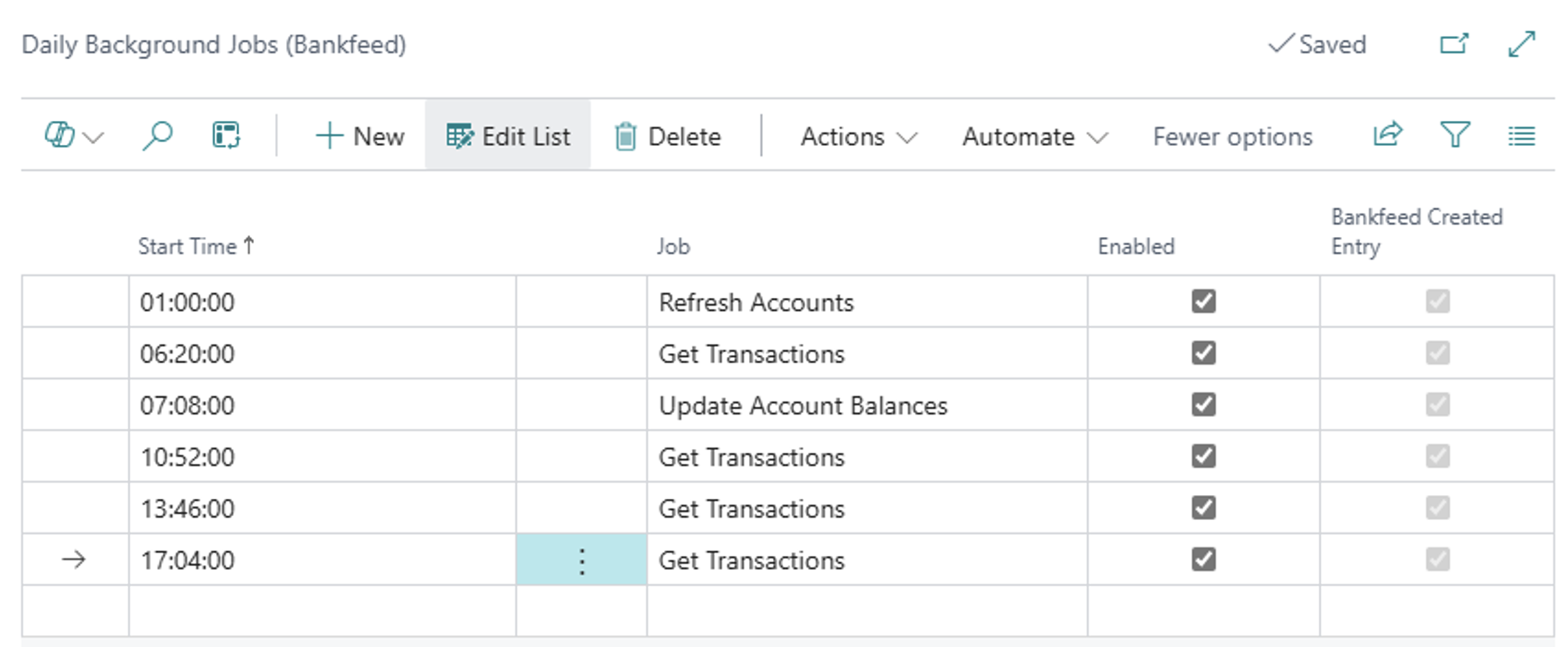

The following table displays the default times for the functions to run, which may vary across organizations.

In the “Start Time” field, you can update the times as needed. Additionally, you have the option to enable or disable the functions by adding or removing a checkmark in the “Enabled” field.

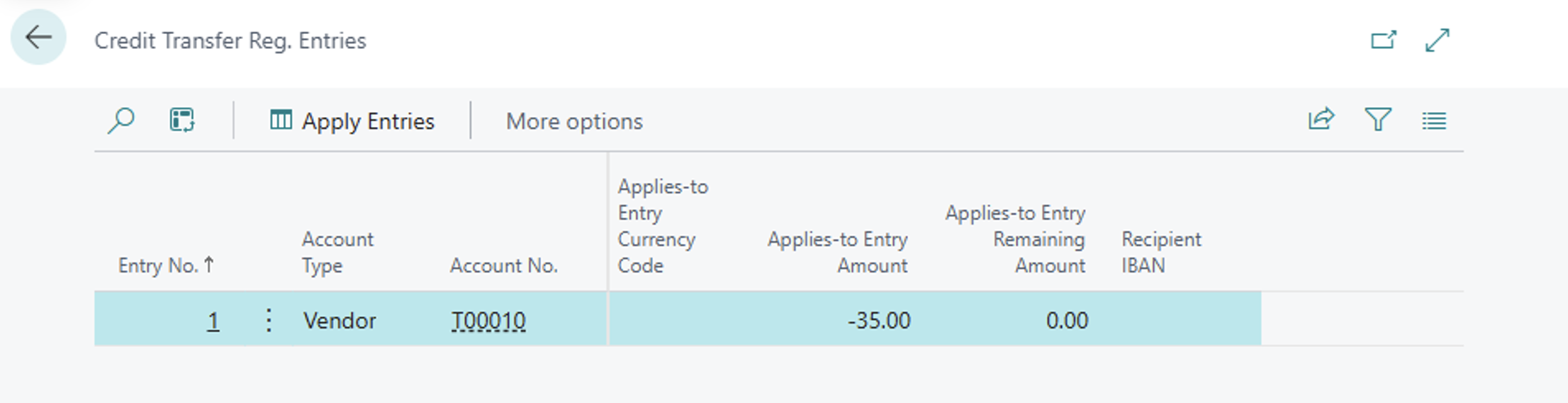

The Vendor account recognition process using the Credit Transfer recognizer has been enhanced by including Closed Credit Transfer entries in the search criteria. Previously, only Open Credit Transfer entries were considered when searching for vendor accounts, which meant that already posted payment entries were excluded from the search results.

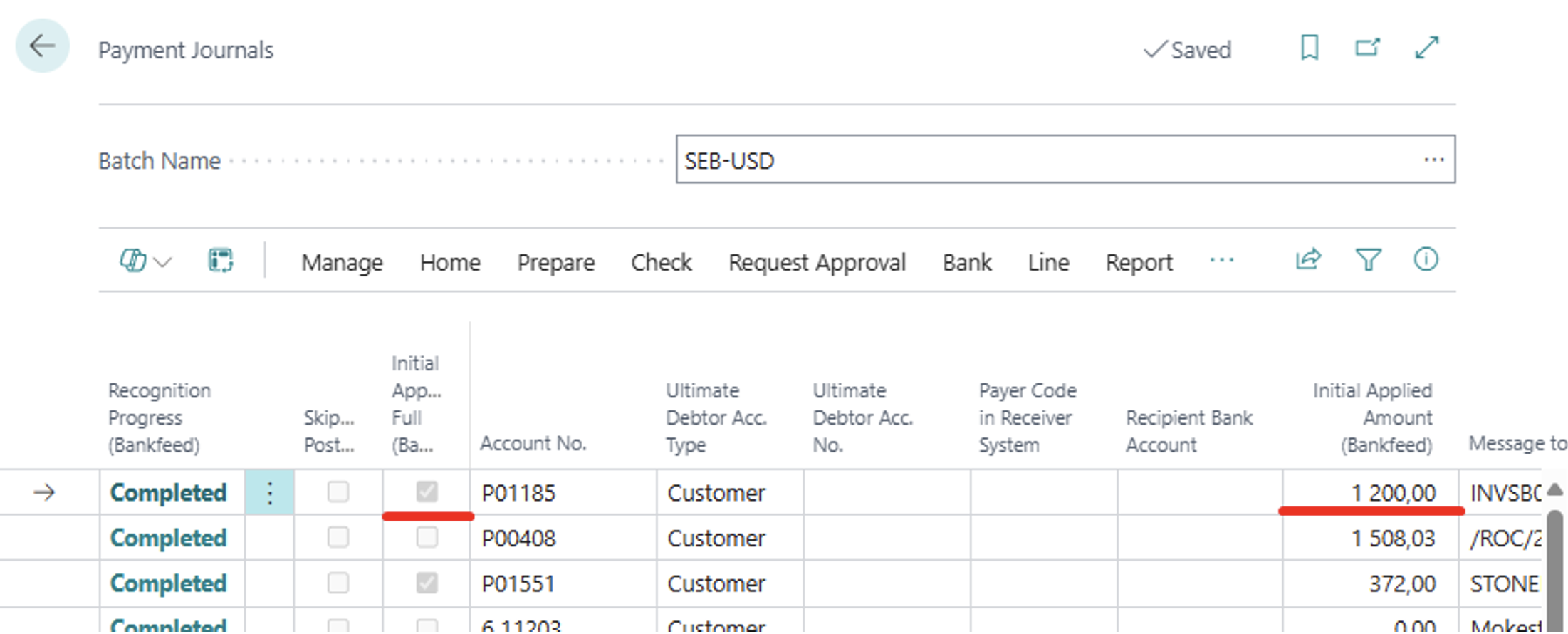

Before this release, information in the fields “Initial Application Full (Bankfeed)” and “Initially Applied Amount (Bankfeed)” was occasionally delayed after the recognition process was completed. We have improved this process to ensure that the information in these fields is updated simultaneously with the recognition process, eliminating any delays.

TRY FOR FREE

HURRAY!

Feel free to leave your question here and we will email you the answer as soon as possible.

Hello,

I found this Dynamics 365 Business Central add-on that would save me tons of time by automatically importing bank statements and matching payments with invoices.

It has certain technical requirements like an up-to-date Business Central version and banks that comply with the PSD2 open banking protocol. Could you please check the requirements and let me know if we are able to use the Bankfeed app?

The requirements are here: www.bankfeed.com/faq/, or you may contact the add-on’s developers at hello@bankfeed.com.

Bankfeed works as an add-on for Microsoft Dynamics 365 Business Central. Therefore the usage of this ERP system is necessary. The solution works best with the three latest versions of Business Central.

Before installing Bankfeed, we recommend checking if the following conditions are met:

1. Open banking API (PSD2) is not occupied.

If you use online payment provider services (Wordline, Wordpay, etc.), they might be connected through an open banking API. Therefore, Bankfeed will not be able to connect to this API as it is already occupied. In these situations, we can connect Bankfeed through the bank’s direct API, known as a Gateway. However, it usually requires additional banking fees and additional implementation hours.

2. Banks provide the information required for recognition and reconciliation.

Even though open banking is regulated using the PSD2 protocol and is mandatory for all EU banks, the banks treat these requirements differently. The amount of information provided through the APIs and its quality can differ depending on the bank. This can lead to a situation where Bankfeed will not be able to properly identify customers/vendors or documents because of the lack of data.

Here is a list of mandatory bank fields needed to enable Bankfeed’s payment recognition and reconciliation. Please check HERE if the banks you are using provide the information from these fields:

Enter your email, and you will immediately receive:

Enter your email, and you will immediately receive:

Enter your information, and you will be contacted regarding a pricing offer that suits your business needs.