An update has been released, and here is an overview of what was improved in Bankfeed version 18.0.

Contact form

Feel free to leave your question here and we will email you the answer as soon as possible.

An update has been released, and here is an overview of what was improved in Bankfeed version 18.0.

Check out the features of Bankfeed.

Following the changes introduced by the European Central Bank, it is now possible to extend the period for linking bank accounts to 180 days (previously, the maximum period was 90 days). Therefore, after making certain adjustments, the process of linking bank accounts will need to be done less frequently – every 180 days. As usual, you will receive a reminder about the approaching deadline one week before the deadline.

So far, when connecting bank accounts to Bankfeed, they were not linked in any way with existing Business Central bank accounts. However, to avoid errors during statement parsing, we have enhanced the functionality by adding automatic or manual linking of bank accounts.

Linking bank accounts is performed as the final step during the bank account connection process using the “Set up Bankfeed Connection” assisted setup.

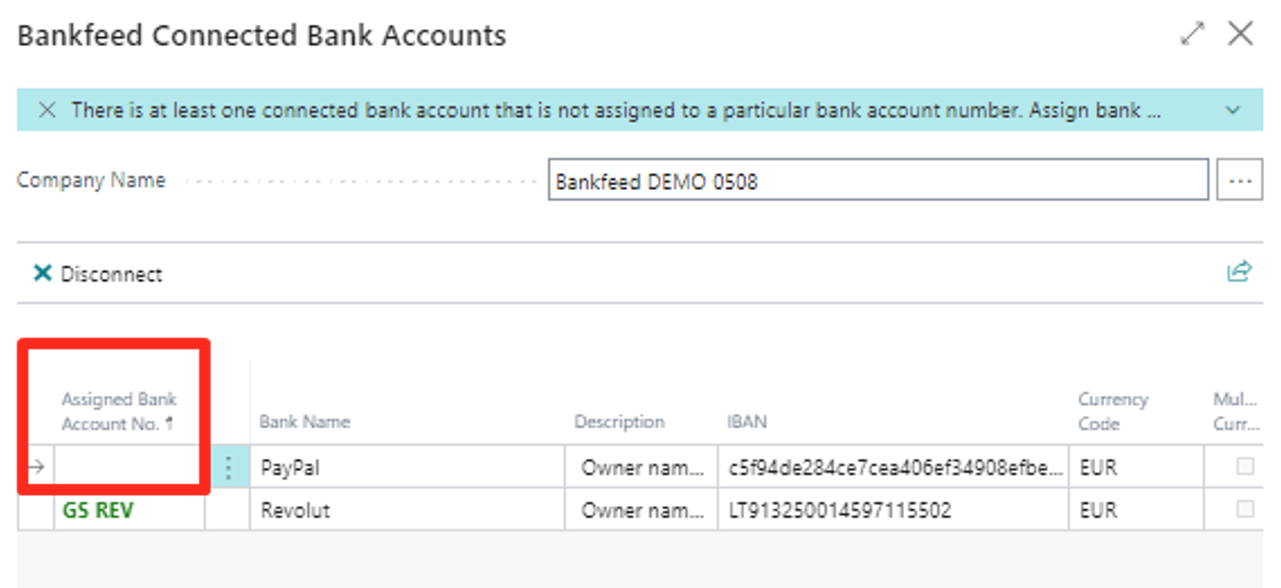

After completing the authentication and consent actions at the bank, a window opens where in the field “Assigned Bank Account No.” you need to specify the number of the bank account card created in Business Central:

If, during the login, Bankfeed finds an already created Business Central bank account card with the corresponding IBAN/Provider bank account ID (Bankfeed) and Currency code, then the linking is done automatically, and there is no need to choose the bank account manually.

If you do not have a bank account created while linking, just choose +New in the field “Assigned Bank Account No.” and create it.

We can also link the connected bank account to an empty Business Central bank account card (without IBAN/Provider bank account ID (Bankfeed) or currency code values). When the bank statement is parsed, the linked Business Central bank account card will be filled with the IBAN or Provider bank account ID (Bankfeed) numbers extracted from the statement.

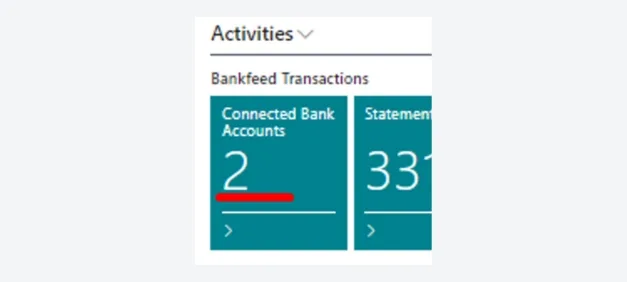

Suppose you want to perform the linking later or check how it is done. In that case, we can see and adjust this information in the “Connected Bank Account” window, which can be opened from the Accounting Role Center or via “Integration set up (Bankfeed)”.

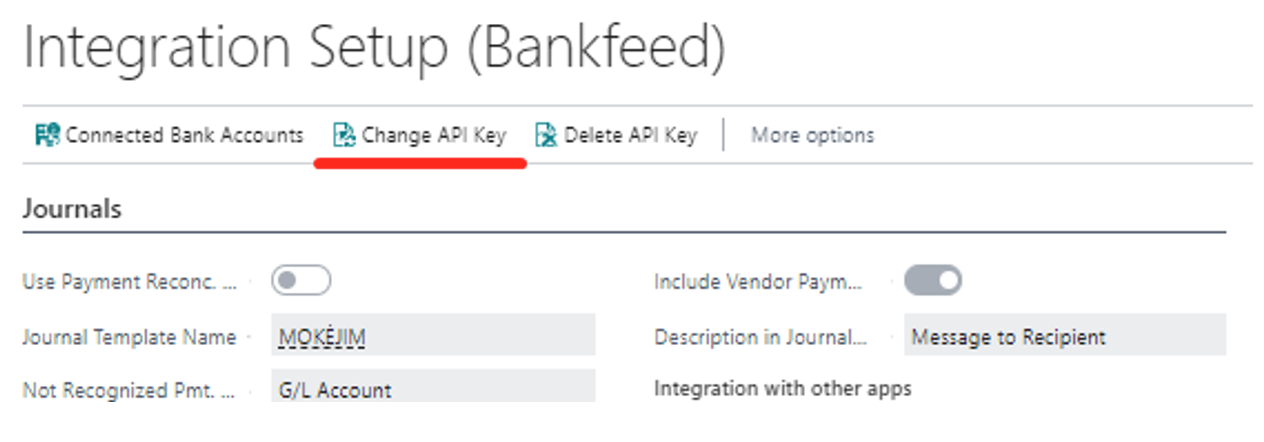

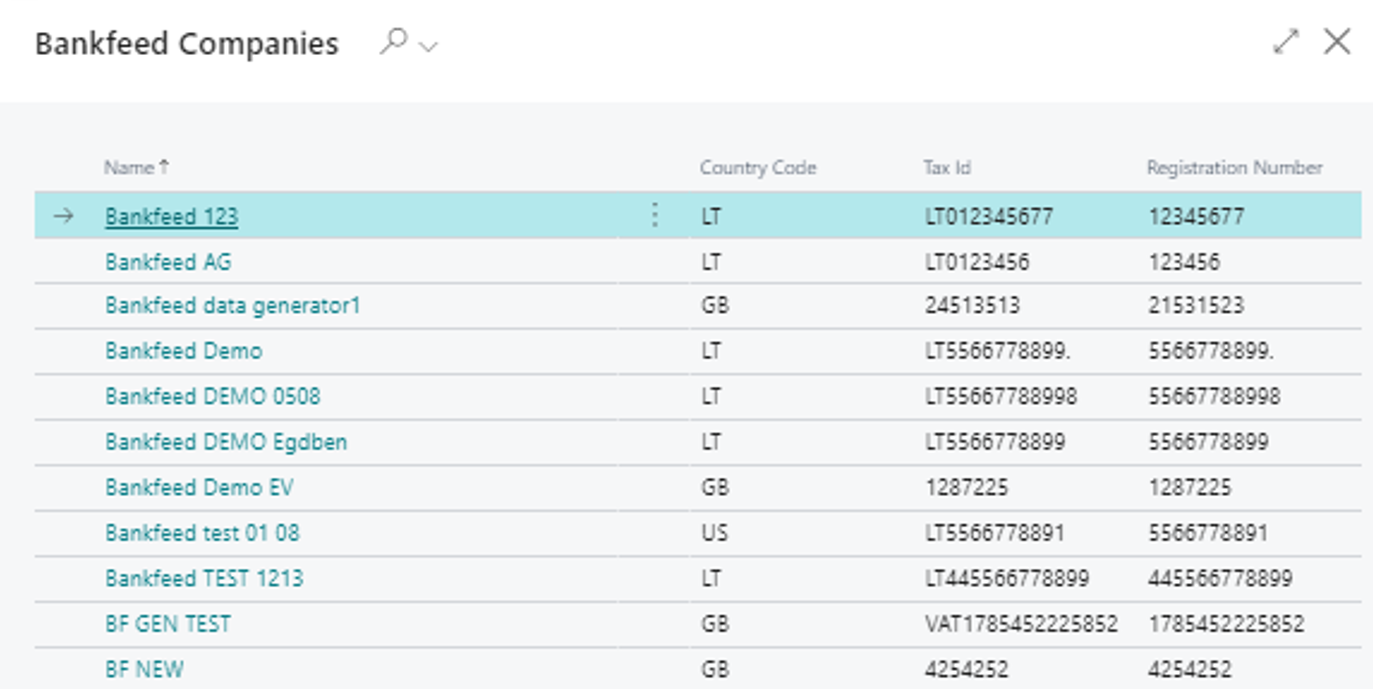

From now on, when using the “Change API Key” function and pasting the API key value, you will be prompted to choose the Bankfeed company you want to connect to the corresponding Business Central company.

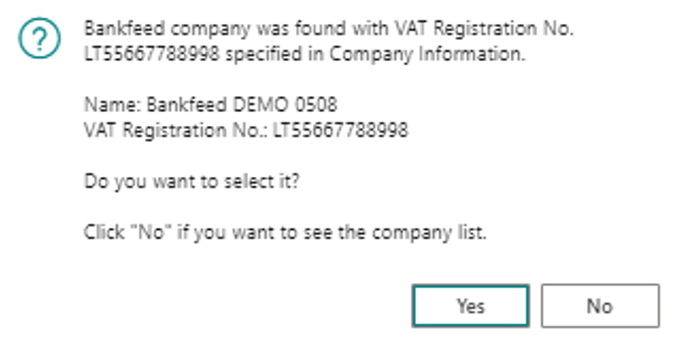

After pasting the API key, if a created Bankfeed company is found based on the “VAT Registration No.” specified on the “Company Information” page, it will be automatically selected.

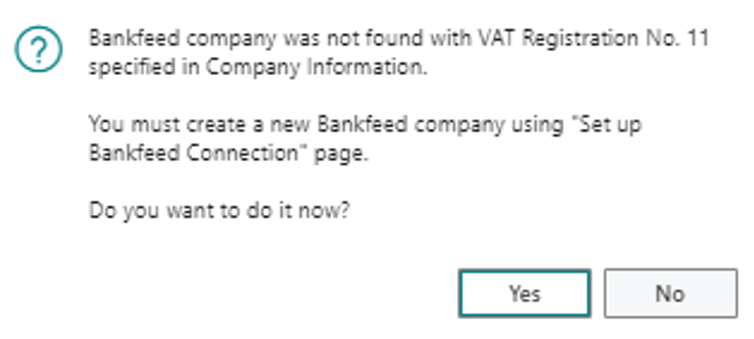

If no matching Bankfeed companies are found, you will be prompted to create a new one.

It is essential to ensure the “VAT Registration No.” specified in the Company Information is correct.

If the “VAT Registration No.” is not filled in on the “Company Information” page, you will be prompted to choose from the list of all Bankfeed companies created for the corresponding API key.

TRY FOR FREE

HURRAY!

Feel free to leave your question here and we will email you the answer as soon as possible.

Hello,

I found this Dynamics 365 Business Central add-on that would save me tons of time by automatically importing bank statements and matching payments with invoices.

It has certain technical requirements like an up-to-date Business Central version and banks that comply with the PSD2 open banking protocol. Could you please check the requirements and let me know if we are able to use the Bankfeed app?

The requirements are here: www.bankfeed.com/faq/, or you may contact the add-on’s developers at hello@bankfeed.com.

Bankfeed works as an add-on for Microsoft Dynamics 365 Business Central. Therefore the usage of this ERP system is necessary. The solution works best with the three latest versions of Business Central.

Before installing Bankfeed, we recommend checking if the following conditions are met:

1. Open banking API (PSD2) is not occupied.

If you use online payment provider services (Wordline, Wordpay, etc.), they might be connected through an open banking API. Therefore, Bankfeed will not be able to connect to this API as it is already occupied. In these situations, we can connect Bankfeed through the bank’s direct API, known as a Gateway. However, it usually requires additional banking fees and additional implementation hours.

2. Banks provide the information required for recognition and reconciliation.

Even though open banking is regulated using the PSD2 protocol and is mandatory for all EU banks, the banks treat these requirements differently. The amount of information provided through the APIs and its quality can differ depending on the bank. This can lead to a situation where Bankfeed will not be able to properly identify customers/vendors or documents because of the lack of data.

Here is a list of mandatory bank fields needed to enable Bankfeed’s payment recognition and reconciliation. Please check HERE if the banks you are using provide the information from these fields:

Enter your email, and you will immediately receive:

Enter your email, and you will immediately receive:

Enter your information, and you will be contacted regarding a pricing offer that suits your business needs.