An update has been released, and here is an overview of what was improved in Bankfeed version 17.1.

Contact form

Feel free to leave your question here and we will email you the answer as soon as possible.

An update has been released, and here is an overview of what was improved in Bankfeed version 17.1.

Check out the features of Bankfeed.

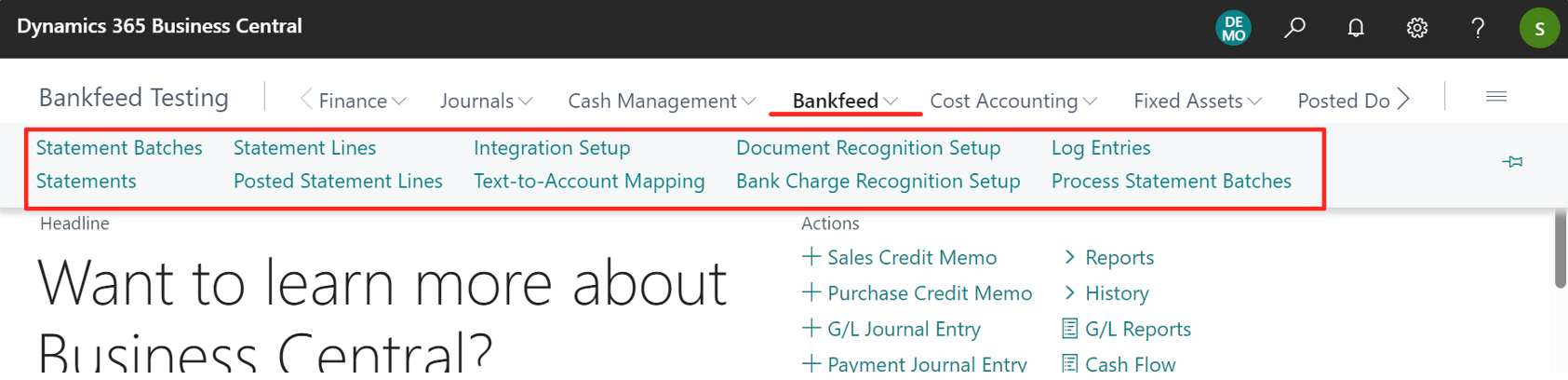

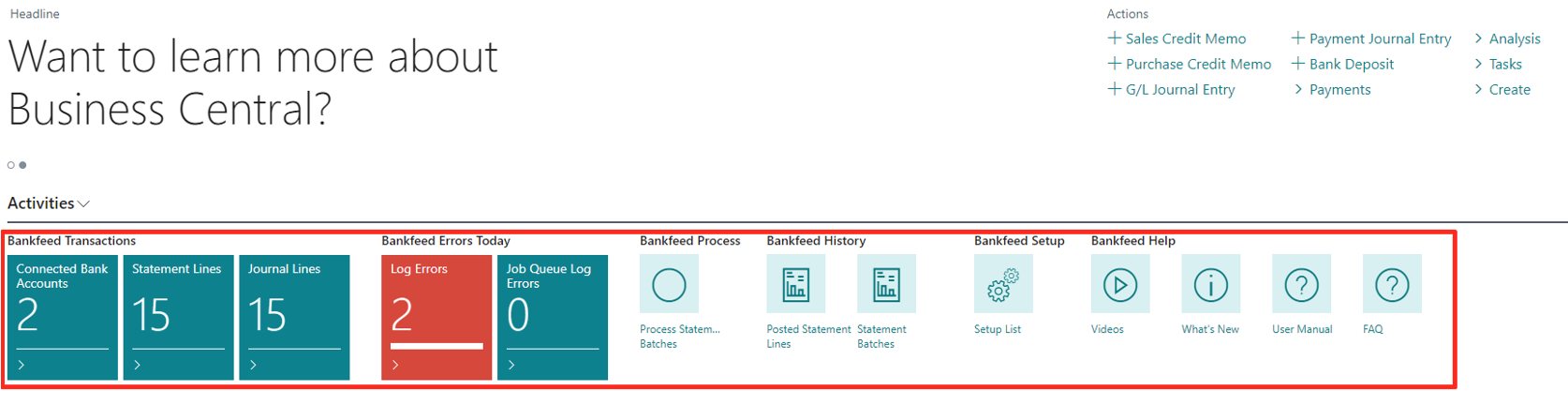

We upgraded the standard Accountant role center in this release, adding Bankfeed actions, pages, and functions. It allows the user to see the critical notifications instantly.

First, the Bankfeed section was added to the Actions bar. If you expand it, you will find all Bankfeed pages in one place.

Second, we have added the Bankfeed area to the Activities.

Let’s take a closer look at the new items here.

Let’s take a closer look at the new items here.

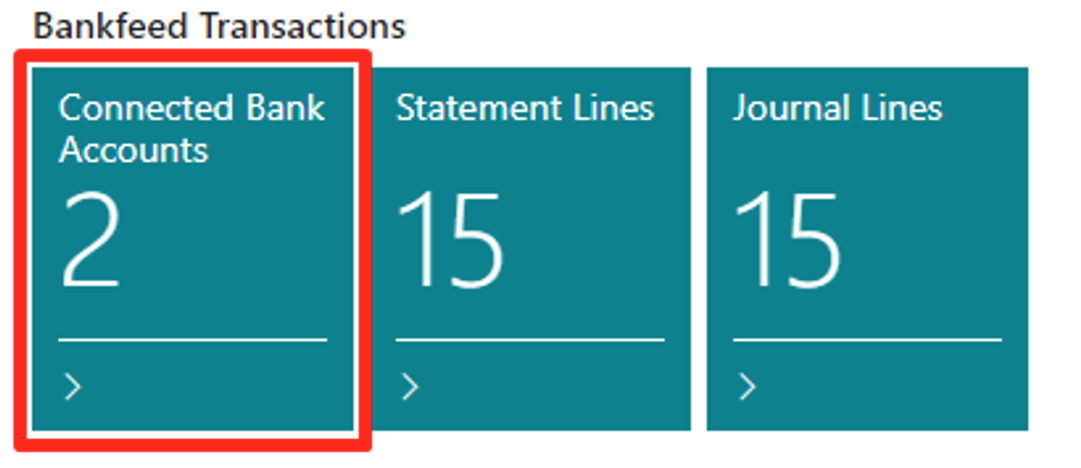

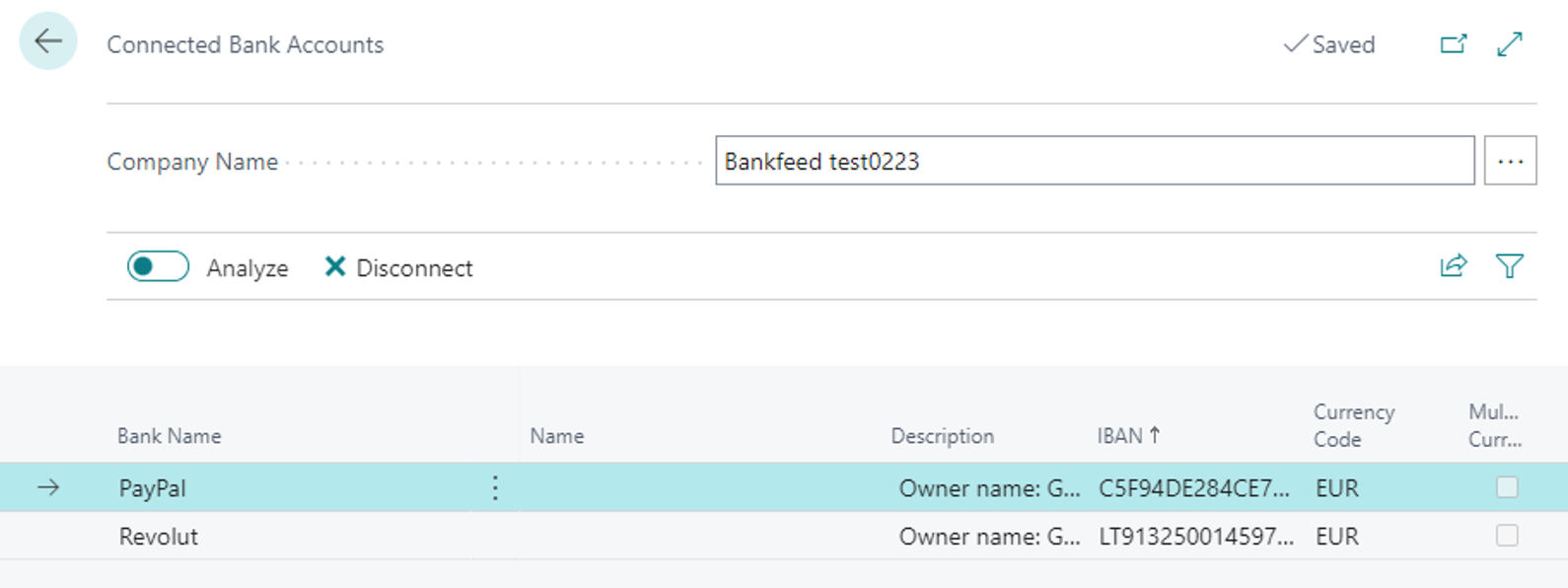

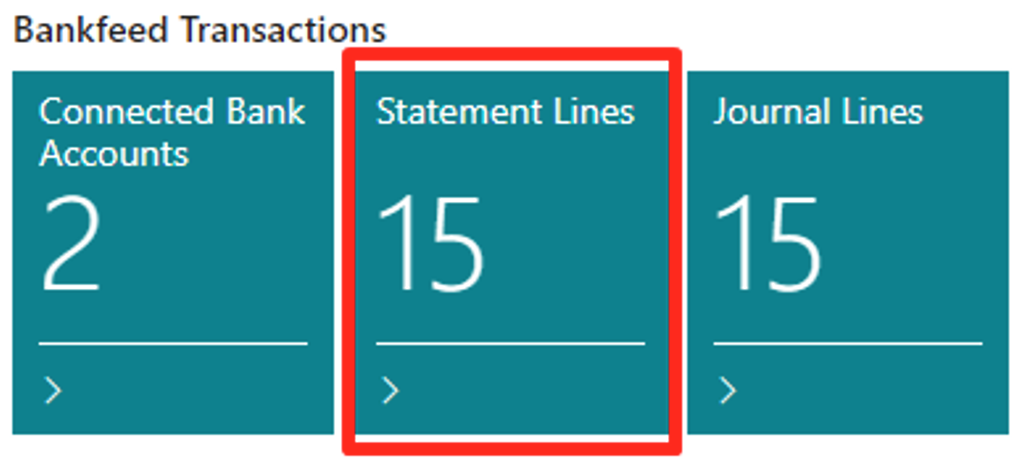

Connected Bank Accounts – shows how many bank accounts are connected to Bankfeed.

If you click the number, you will see the detailed information about the connected bank accounts.

If you click the number, you will see the detailed information about the connected bank accounts.

Statement Lines – shows how many unposted Statement lines are uploaded. If you click on it, the “Statement Lines (Bankfeed)” page will open.

Statement Lines – shows how many unposted Statement lines are uploaded. If you click on it, the “Statement Lines (Bankfeed)” page will open.

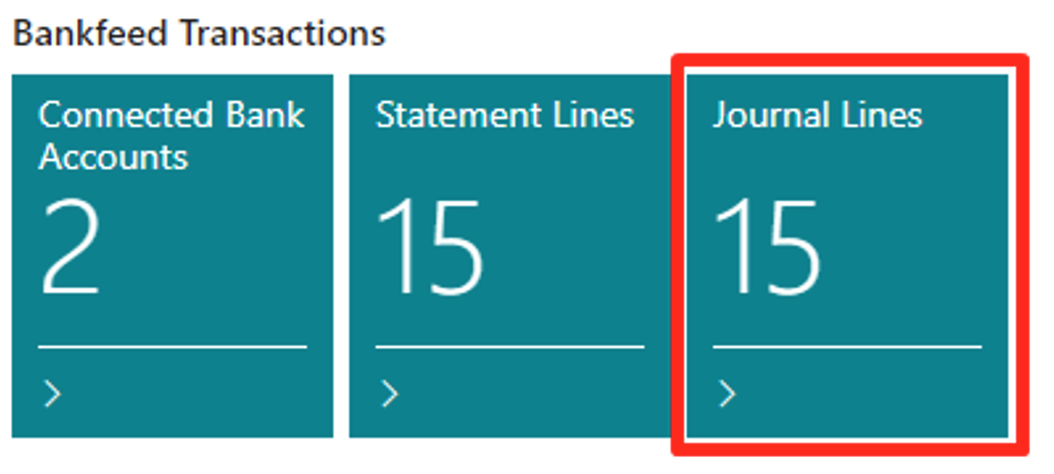

Journal Lines - shows how many unposted transactions are in the journals. Which journal lines will be calculated (payment, cash receipt, payment reconciliation) depends on the journal chosen in the assisted setup.

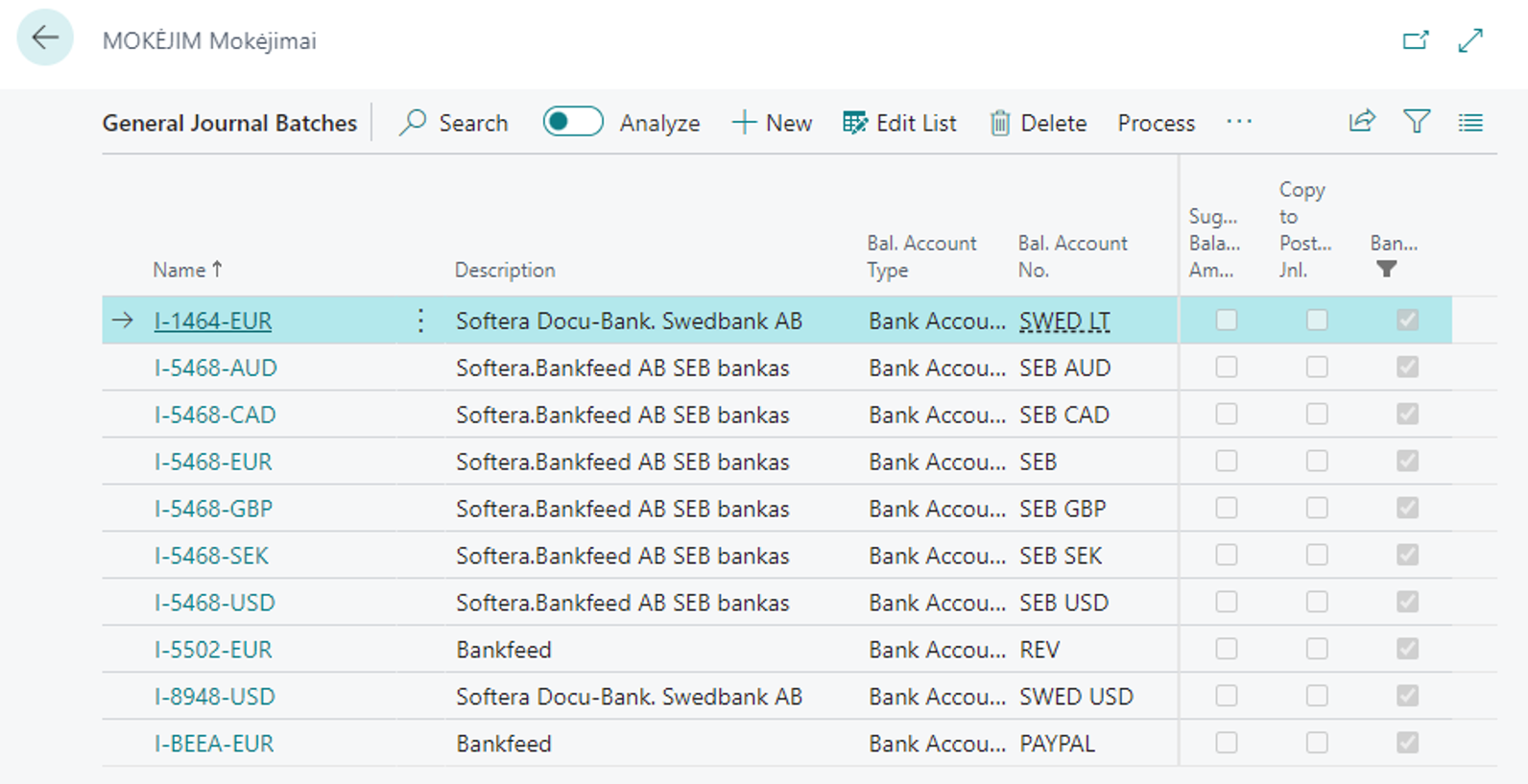

By clicking on it, you will open the list of the journal batches (if more than one journal batch is used).

By clicking on it, you will open the list of the journal batches (if more than one journal batch is used).

Only Bankfeed journal batches are shown.

Only Bankfeed journal batches are shown.

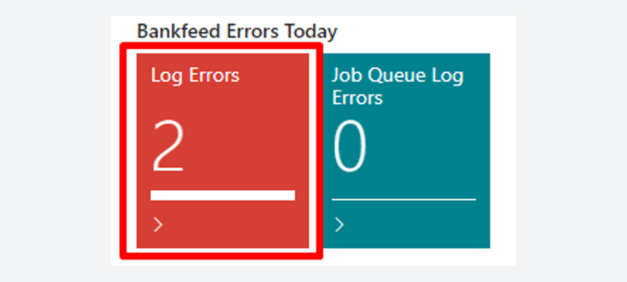

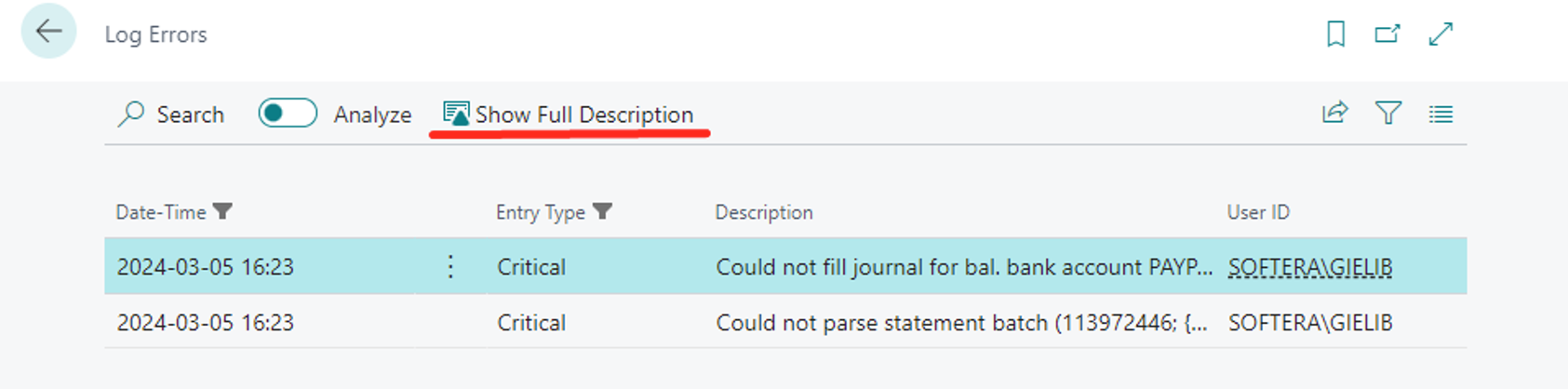

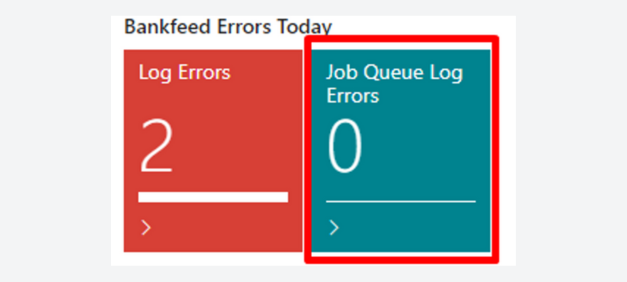

Log Errors – shows how many errors the function “Process statement batches (Bankfeed)” had today.

By clicking on it, you will open the “Log Errors” page and will see all the detailed information about the errors that occurred.

Job Queue Log Errors – shows how many errors the Job queue entry, which runs the function “Process Statement Batches”, had today. If you click on it, the job queue log entries with detailed information will open.

Process Statement Batches – this button will run the “Process Statement Batches (Bankfeed)” function.

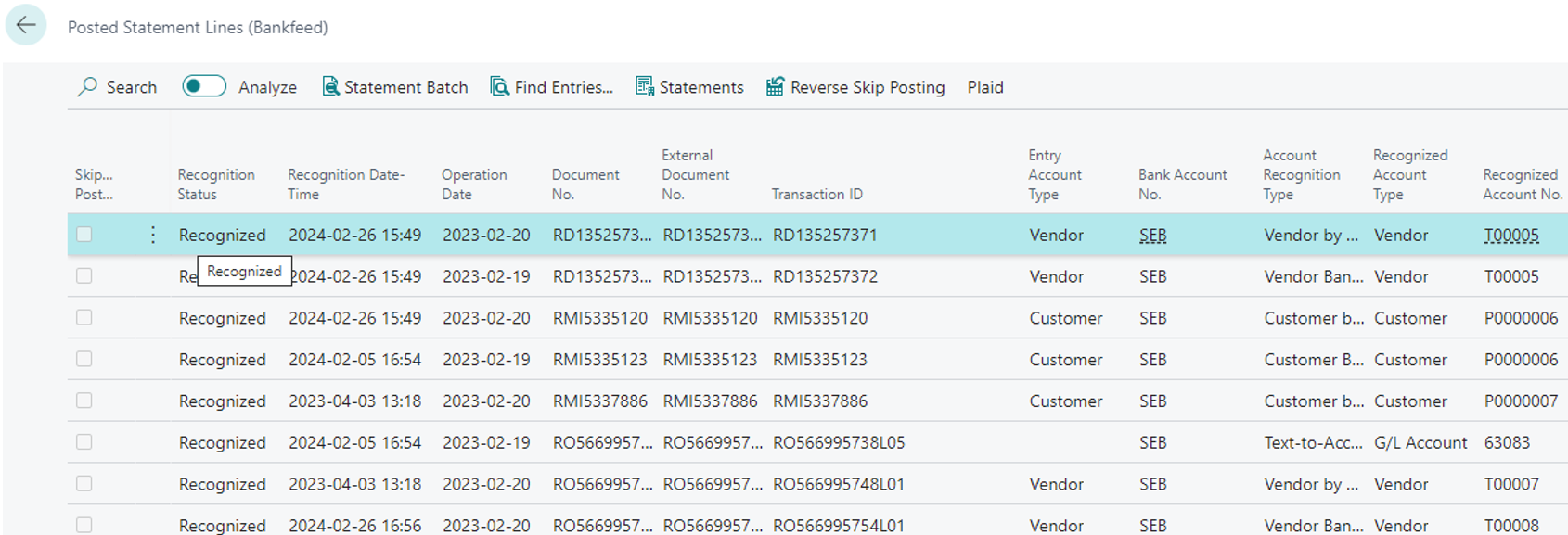

Posted Statement Lines – this button will open the “Posted Statement Lines (Bankfeed)” page.

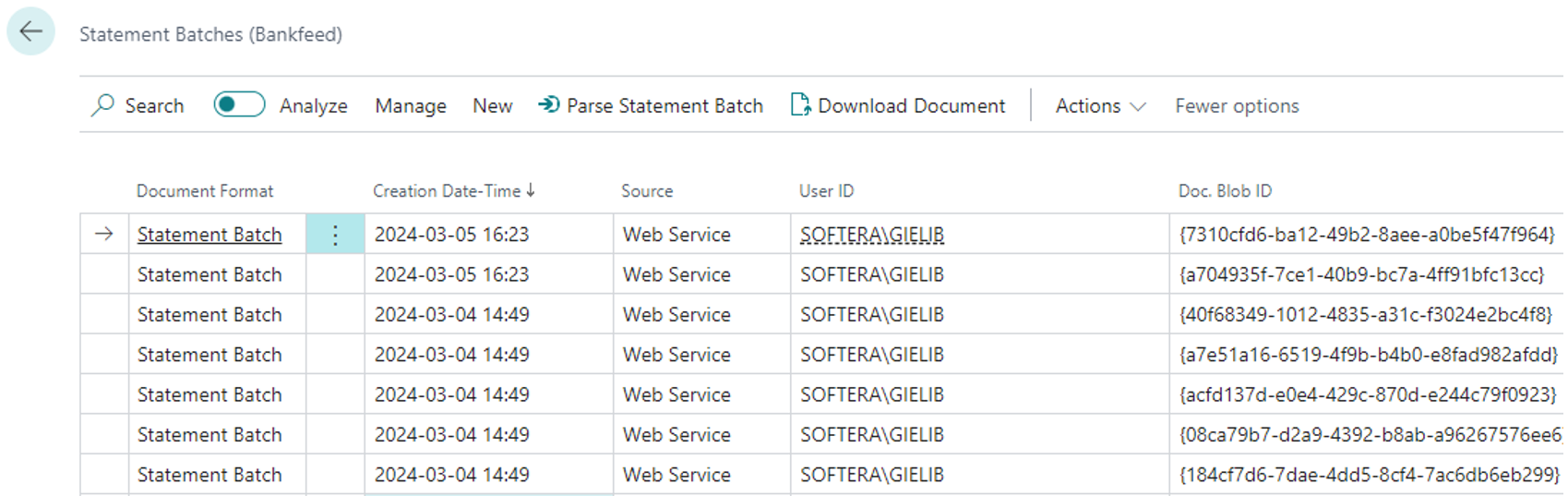

Statement Batches – this button will open the page “Statement Batches (Bankfeed)”.

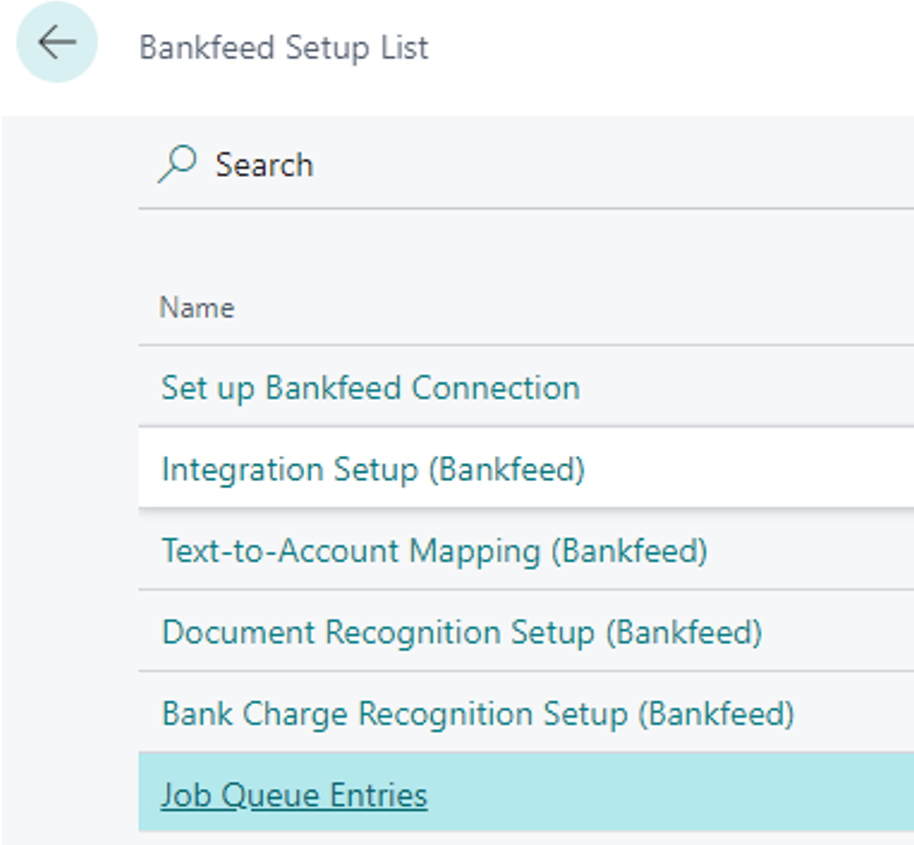

Setup List – this button will open the list of all Bankfeed setups in one place.

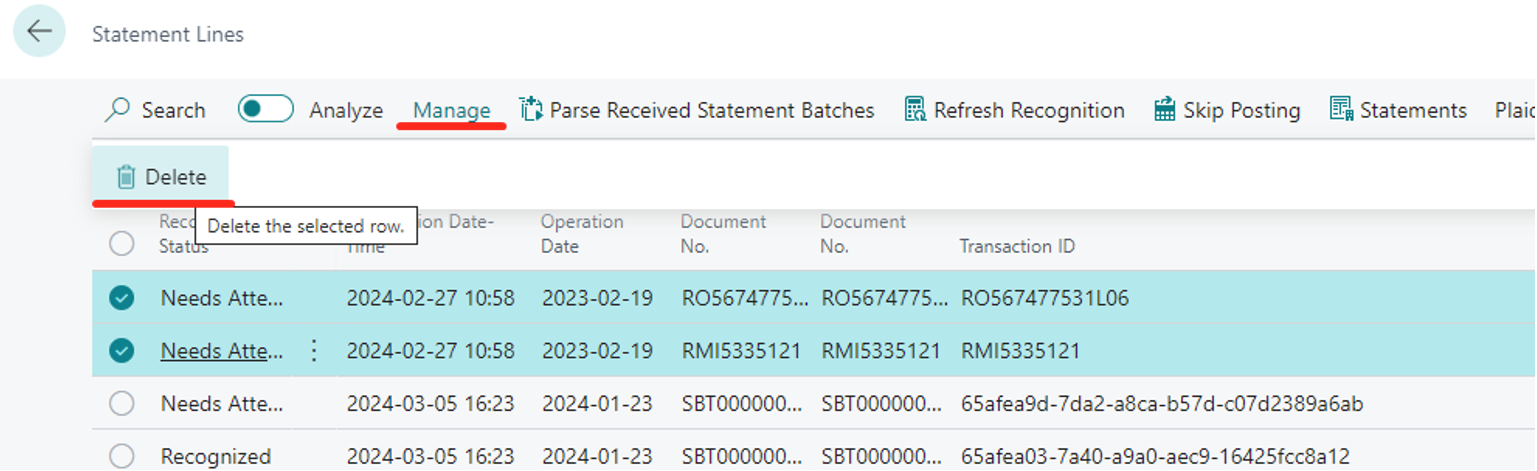

Before this release, if the user deleted Statement lines, they had to go to the journal and delete the related lines. Now we have improved the Statement line deletion, so that after deleting the Statement lines, the related journal lines will be deleted automatically.

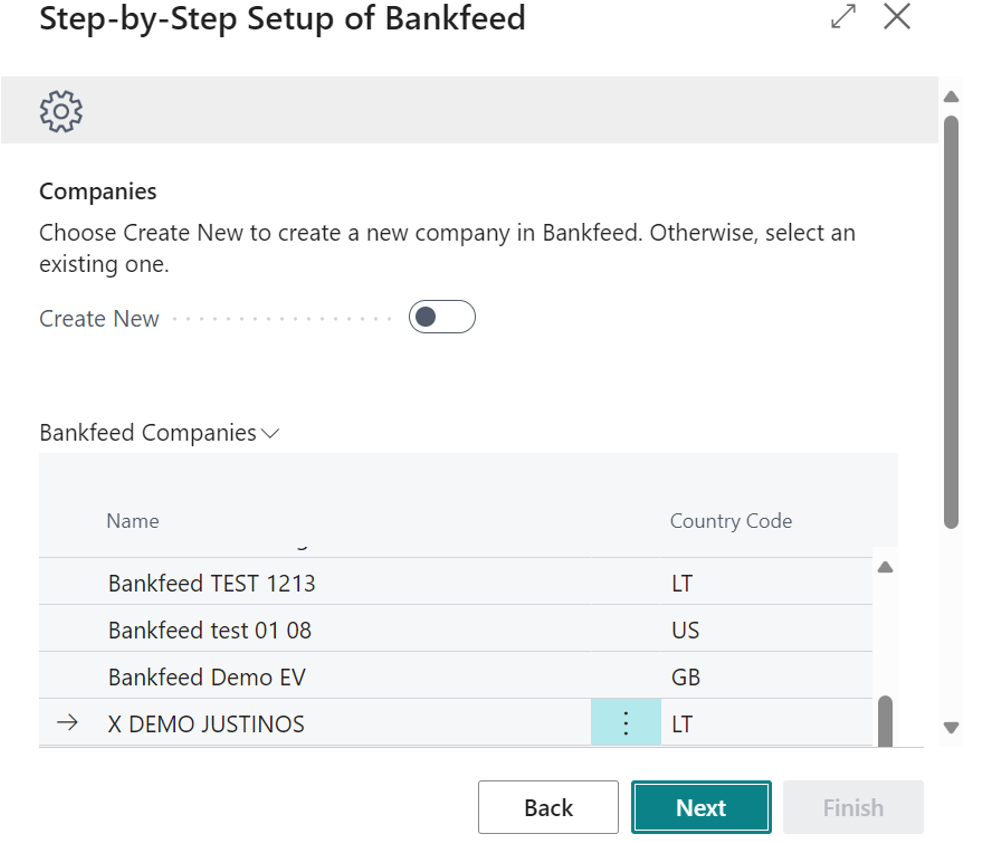

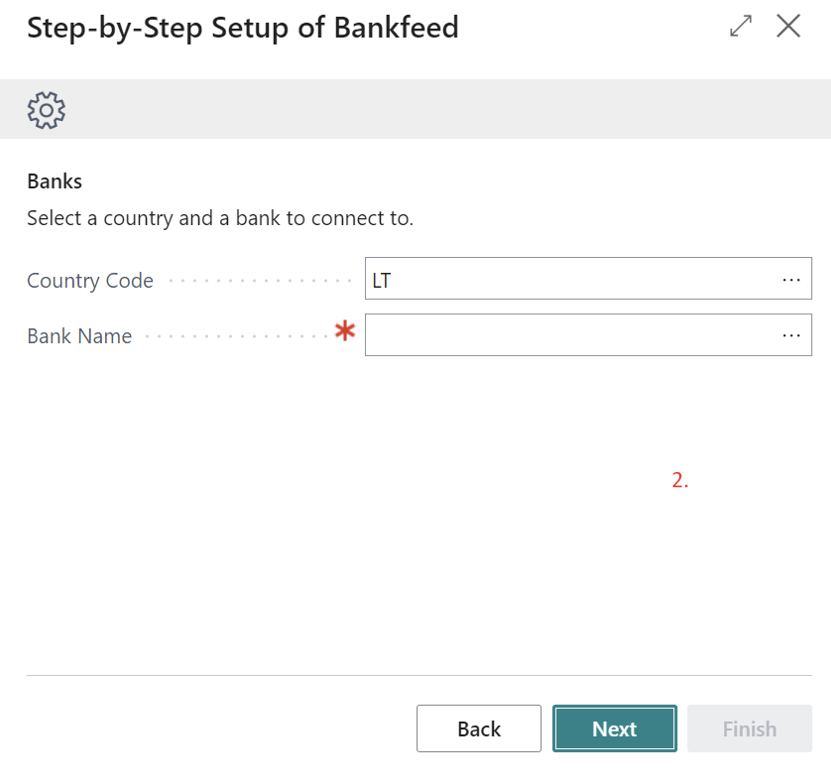

Before this release, if the user had connected a few organizations to Bankfeed and wanted to reconnect bank accounts while running the assisted setup “Set up Bankfeed connection”, they had to choose which organization’s bank accounts they would reconnect.

Now, this step is skipped, and the user, by default, is working with the organization they had connected to before. Eliminating this step also prevents mistakes which occured by choosing the wrong organization.

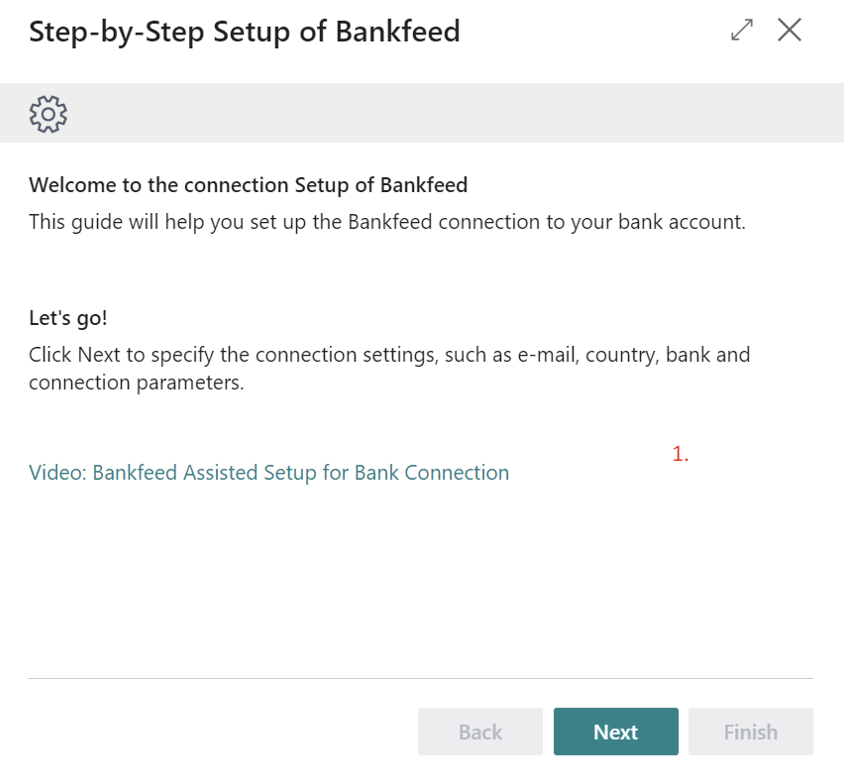

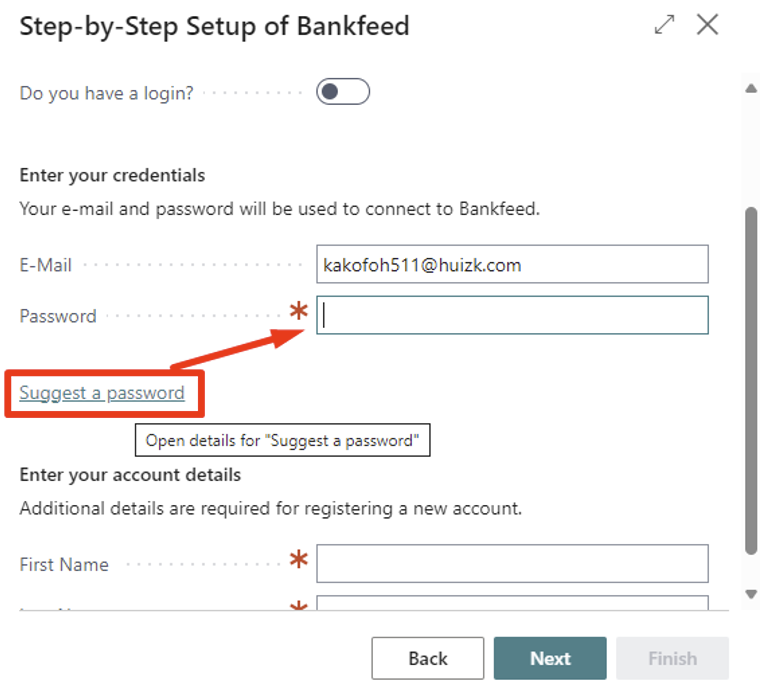

In this release, we enabled automatic password suggestions for the new users who will be creating their organizations in Bankfeed. Before this, it was challenging for some users to provide a password that meets all the security requirements.

TRY FOR FREE

HURRAY!

Feel free to leave your question here and we will email you the answer as soon as possible.

Hello,

I found this Dynamics 365 Business Central add-on that would save me tons of time by automatically importing bank statements and matching payments with invoices.

It has certain technical requirements like an up-to-date Business Central version and banks that comply with the PSD2 open banking protocol. Could you please check the requirements and let me know if we are able to use the Bankfeed app?

The requirements are here: www.bankfeed.com/faq/, or you may contact the add-on’s developers at hello@bankfeed.com.

Bankfeed works as an add-on for Microsoft Dynamics 365 Business Central. Therefore the usage of this ERP system is necessary. The solution works best with the three latest versions of Business Central.

Before installing Bankfeed, we recommend checking if the following conditions are met:

1. Open banking API (PSD2) is not occupied.

If you use online payment provider services (Wordline, Wordpay, etc.), they might be connected through an open banking API. Therefore, Bankfeed will not be able to connect to this API as it is already occupied. In these situations, we can connect Bankfeed through the bank’s direct API, known as a Gateway. However, it usually requires additional banking fees and additional implementation hours.

2. Banks provide the information required for recognition and reconciliation.

Even though open banking is regulated using the PSD2 protocol and is mandatory for all EU banks, the banks treat these requirements differently. The amount of information provided through the APIs and its quality can differ depending on the bank. This can lead to a situation where Bankfeed will not be able to properly identify customers/vendors or documents because of the lack of data.

Here is a list of mandatory bank fields needed to enable Bankfeed’s payment recognition and reconciliation. Please check HERE if the banks you are using provide the information from these fields:

Enter your email, and you will immediately receive:

Enter your email, and you will immediately receive:

Enter your information, and you will be contacted regarding a pricing offer that suits your business needs.