Here comes Microsoft Copilot. Saying that it’s an AI based on a large language model won’t say much – it’s easier to see it as your personal assistant ready to help you in the ways you need the most. Step by step, Microsoft is introducing it across their product line, with Business Central being no exception.

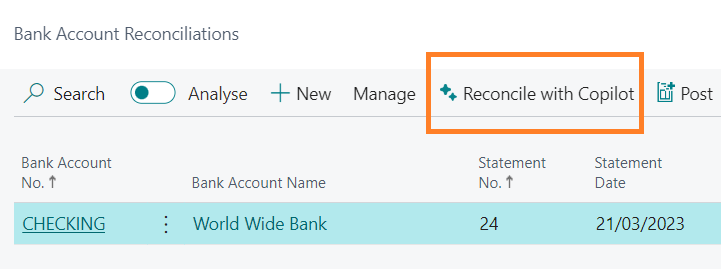

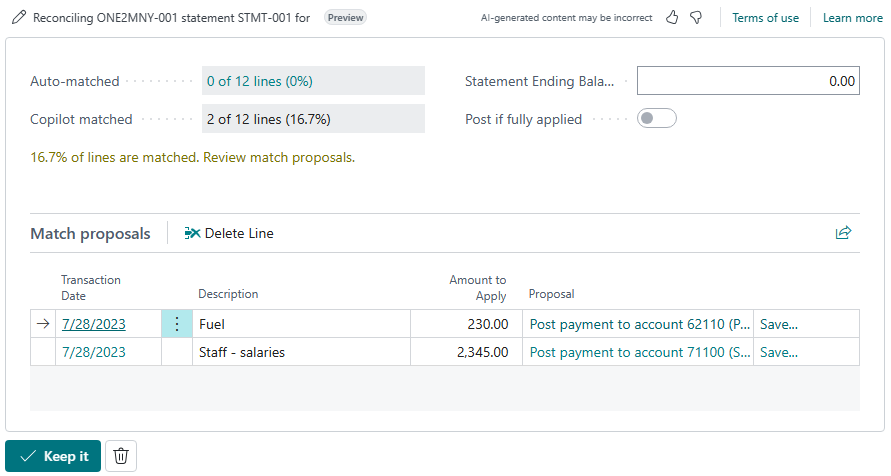

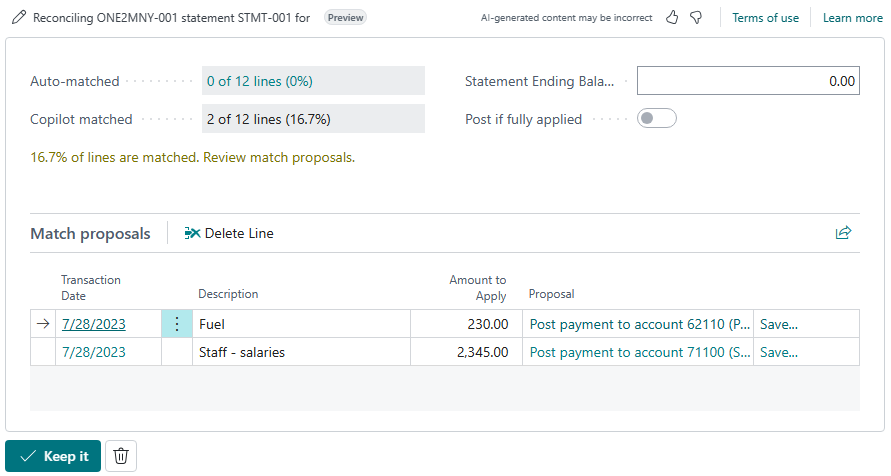

As a proof of concept, Microsoft presents us with additional help in the reconciliation process using the “Reconcile with Copilot” feature. It inspects the remaining transactions after the rule-based matching and identifies more matches based on the dates, amounts, and descriptions. For example, if a customer paid multiple invoices as one lump sum, Copilot reconciles the single bank statement line with the multiple invoice ledger entries.

In addition, Copilot suggests the most likely G/L account to post any residual transactions to and offers the opportunity to remember a specific transaction description for the next reconciliation. For example, Copilot might suggest that the transaction with the description “Fuel Stop24” should be posted to the “Transportation” account.

However, being just a proof-of-concept, it has its limitations. As a generic AI, Copilot may not cater perfectly to industry or business-specific nuances without extensive training. It also performs best when G/L account names, ledger entry descriptions, and bank transaction descriptions are all in the same language, preferably – English. Mixed languages often result in fewer matches and suggestions – at least for now.

It’s a powerful tool, though. With smart usage, Copilot can generate new matching rules, help detect or explain discrepancies and take care of some rare but specific scenarios. And that’s also exactly what you should expect from the upcoming releases of Bankfeed. We’ll give you a sneak peek into that.