An update has been released, and here is an overview of what was improved in Bankfeed version 16.0.

Contact form

Feel free to leave your question here and we will email you the answer as soon as possible.

An update has been released, and here is an overview of what was improved in Bankfeed version 16.0.

Check out the features of Bankfeed.

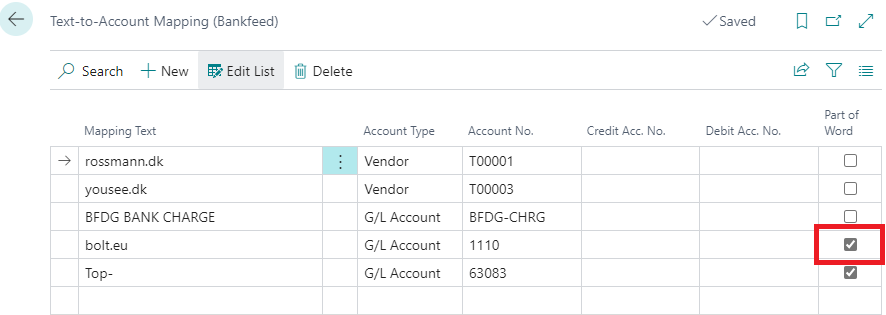

Sometimes, when we have many Credit card operations, we see that information about the payment in “Message to Recipient” is just one big piece of text and symbols, a mix of different information. In such cases, “Text-to-Account Mapping (Bankfeed)” did not work, as there were no spaces between the words — for example “bolt.eu/r/2310120524 CARD_PAYMENT” transaction text.

For such cases, there is a new setup, “Part of Word”, which enables searching for parts of the text:

Warning

Try to use as much text in “Mapping Text” as possible because using tiny parts of the words may result in finding the wrong cases. For example, if I want to recognise transactions with the text “Top-Up by *0048 TOPUP”, it’s not enough to enter “top” in “Mapping Text” because transactions with “Stop” and “Autopay” and “TOPUP” also will be recognised. Use “Top-” in “Mapping Text” in this example.

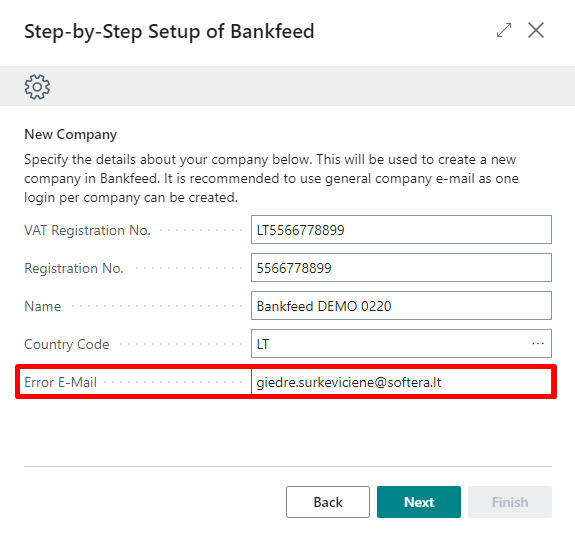

It is important to inform Bankfeed users if any issues with the Bank account connections or other problems occur. For this purpose, we added a new field, “Error E-Mail”, in the Assisted Setup “Set up Bankfeed Connection”.

By default, this field will be filled with the same email as the one used for creating the account, but it can be changed.

Information

Adding an “Error E-Mail” will be valid only for newly created accounts.

If you already have a company account and want to add/change the Error E-Mail, please contact support@bankfeed.com.

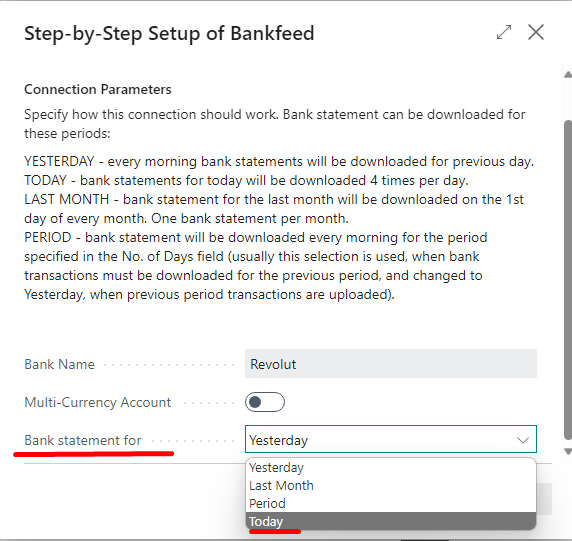

From now on, connecting bank accounts with the “Bank statement for” option “Today” means that you will get Today’s and Yesterday’s transactions in one statement. It was done to avoid time gaps, in which some transactions are not covered.

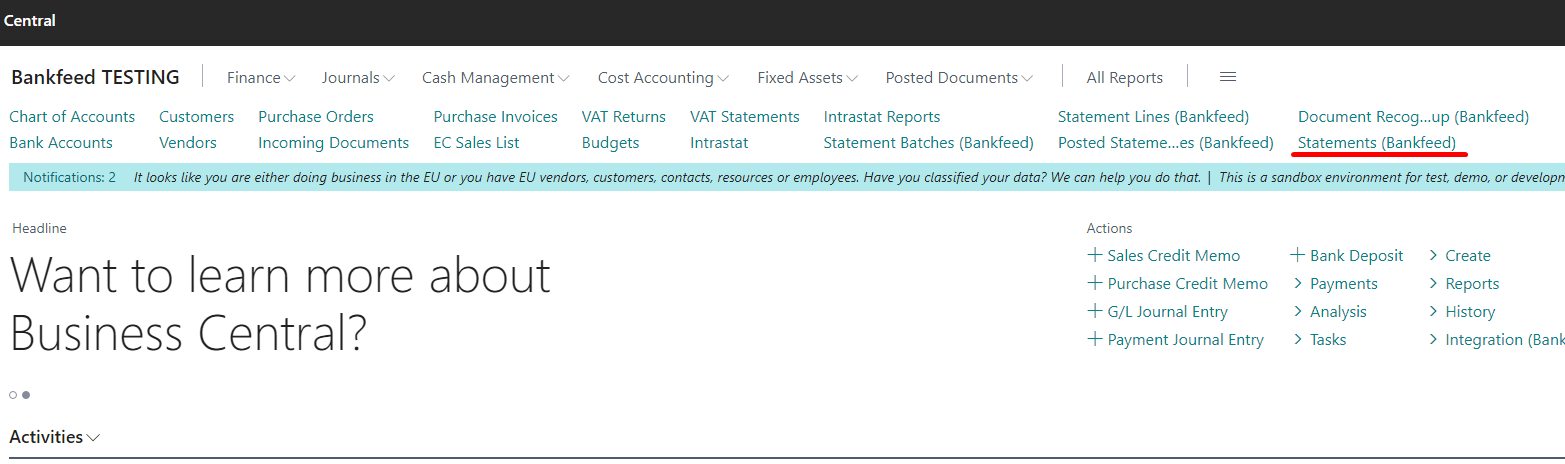

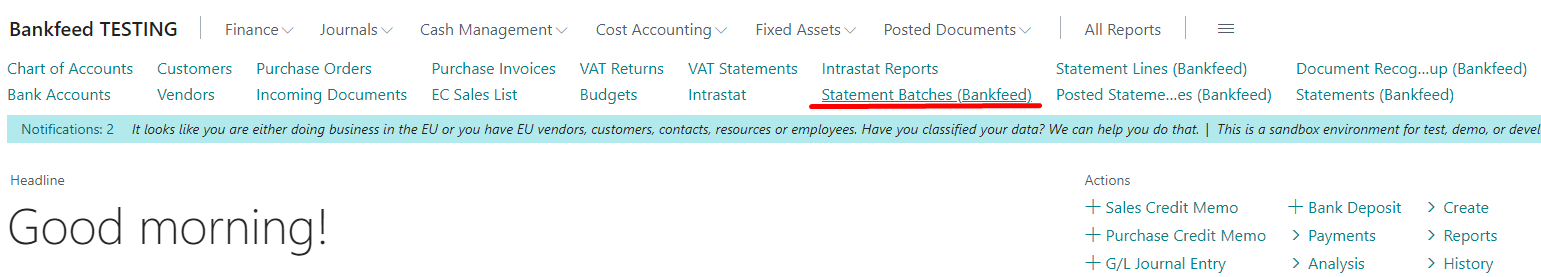

In the Business Central Accountant Role center, we added the page “Statements (Banfeed)” so it is easier to reach.

We also renamed one page “Received/Sent Documents (Bankfeed)” to “Statement Batches (Bankfeed)”, so the names would be the same everywhere.

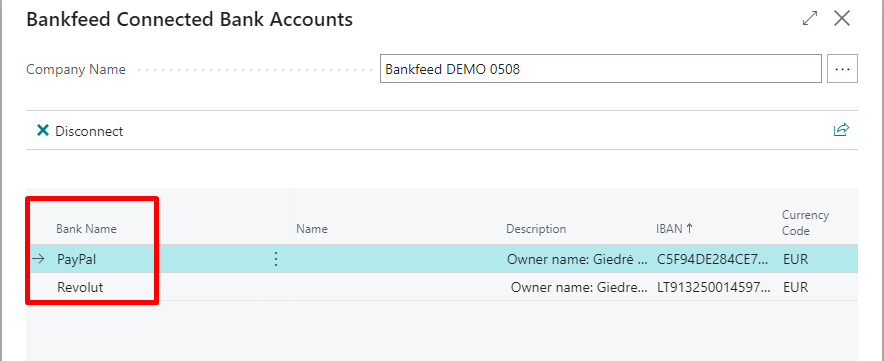

Sometimes, it is easier for the users to identify the bank by its name, so we added the “Bank name” to the “Bankfeed Connected Bank Accounts” list.

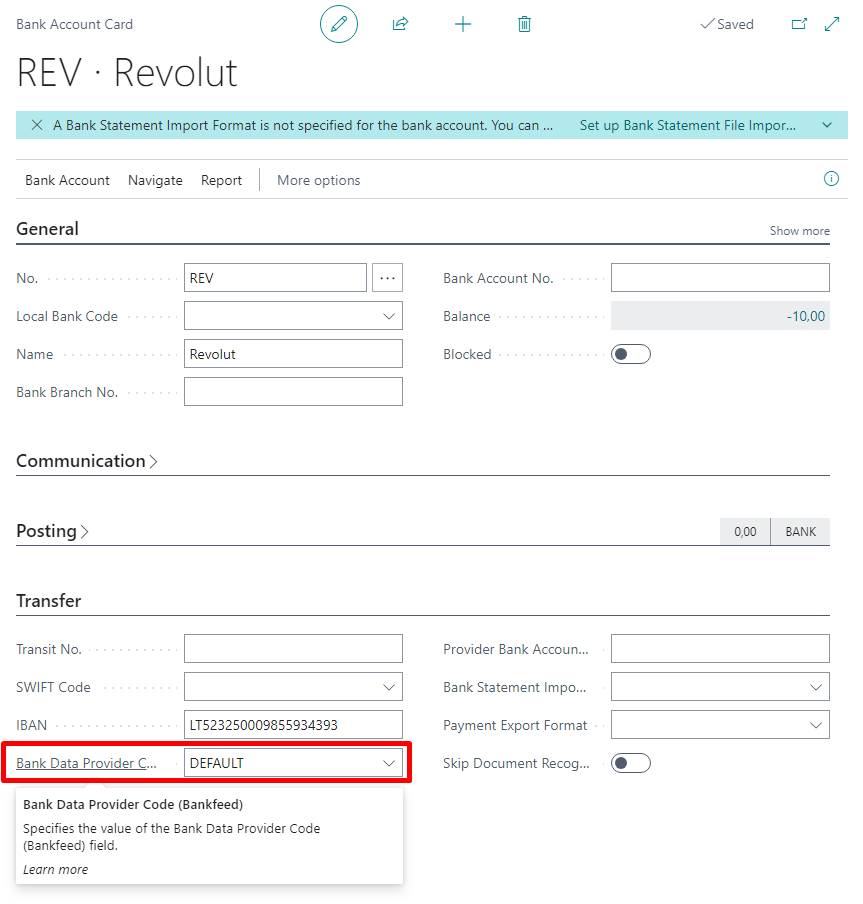

In the previous release, we added a new field to the Bank Account Card – “Bank Data Provider Code (Bankfeed)”. The user had to fill this field with the value in the newly created Bank Account Cards to use Bankfeed. We made some changes in filling this field.

From now on, the user does not have to fill it in; it’s done automatically for the existing Bank Account Cards, when the Assisted setup is initiated, and on creating new ones. The field is filled with the value “DEFAULT”.

Information

For the companies who are operating in the USA or Canada, Bankfeed will add another value – “PLAID”.

TRY FOR FREE

HURRAY!

Feel free to leave your question here and we will email you the answer as soon as possible.

Hello,

I found this Dynamics 365 Business Central add-on that would save me tons of time by automatically importing bank statements and matching payments with invoices.

It has certain technical requirements like an up-to-date Business Central version and banks that comply with the PSD2 open banking protocol. Could you please check the requirements and let me know if we are able to use the Bankfeed app?

The requirements are here: www.bankfeed.com/faq/, or you may contact the add-on’s developers at hello@bankfeed.com.

Bankfeed works as an add-on for Microsoft Dynamics 365 Business Central. Therefore the usage of this ERP system is necessary. The solution works best with the three latest versions of Business Central.

Before installing Bankfeed, we recommend checking if the following conditions are met:

1. Open banking API (PSD2) is not occupied.

If you use online payment provider services (Wordline, Wordpay, etc.), they might be connected through an open banking API. Therefore, Bankfeed will not be able to connect to this API as it is already occupied. In these situations, we can connect Bankfeed through the bank’s direct API, known as a Gateway. However, it usually requires additional banking fees and additional implementation hours.

2. Banks provide the information required for recognition and reconciliation.

Even though open banking is regulated using the PSD2 protocol and is mandatory for all EU banks, the banks treat these requirements differently. The amount of information provided through the APIs and its quality can differ depending on the bank. This can lead to a situation where Bankfeed will not be able to properly identify customers/vendors or documents because of the lack of data.

Here is a list of mandatory bank fields needed to enable Bankfeed’s payment recognition and reconciliation. Please check HERE if the banks you are using provide the information from these fields:

Enter your email, and you will immediately receive:

Enter your email, and you will immediately receive:

Enter your information, and you will be contacted regarding a pricing offer that suits your business needs.